Summary

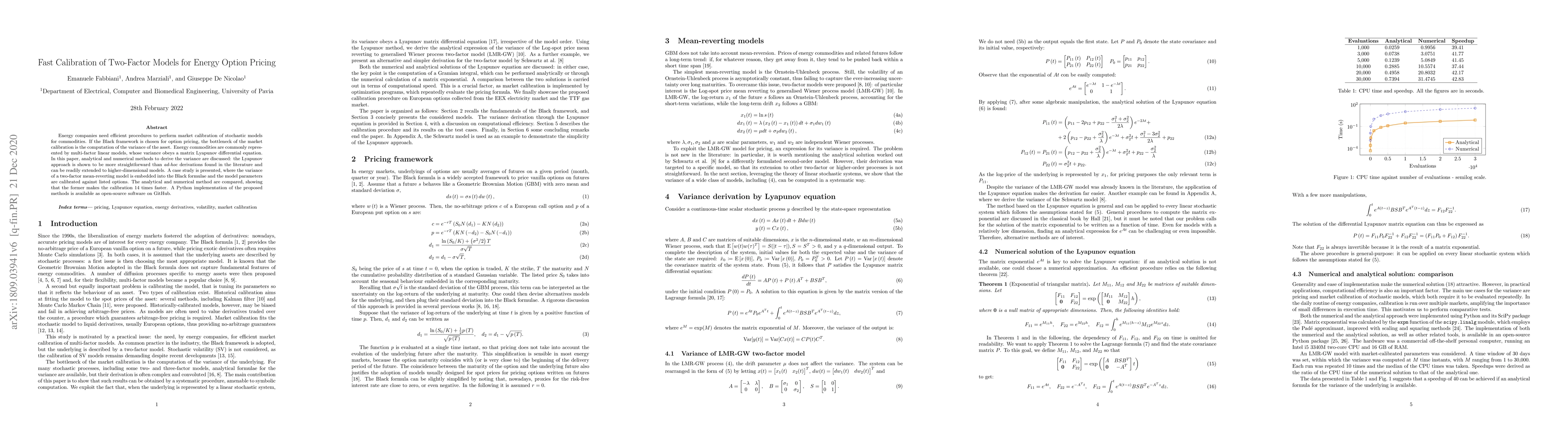

Energy companies need efficient procedures to perform market calibration of stochastic models for commodities. If the Black framework is chosen for option pricing, the bottleneck of the market calibration is the computation of the variance of the asset. Energy commodities are commonly represented by multi-factor linear models, whose variance obeys a matrix Lyapunov differential equation. In this paper, analytical and numerical methods to derive the variance are discussed: the Lyapunov approach is shown to be more straightforward than ad-hoc derivations found in the literature and can be readily extended to higher-dimensional models. A case study is presented, where the variance of a two-factor mean-reverting model is embedded into the Black formulae and the model parameters are calibrated against listed options. The analytical and numerical method are compared, showing that the former makes the calibration 14 times faster. A Python implementation of the proposed methods is available as open-source software on GitHub.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFast American Option Pricing using Nonlinear Stencils

Yushen Huang, Rathish Das, Reilly Browne et al.

Deep Calibration With Artificial Neural Network: A Performance Comparison on Option Pricing Models

Jaehyung Choi, Young Shin Kim, Hyangju Kim

Pragmatic Comparison Analysis of Alternative Option Pricing Models

Muhammad Usman, Chandan Kumar, Natasha Latif et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)