Authors

Summary

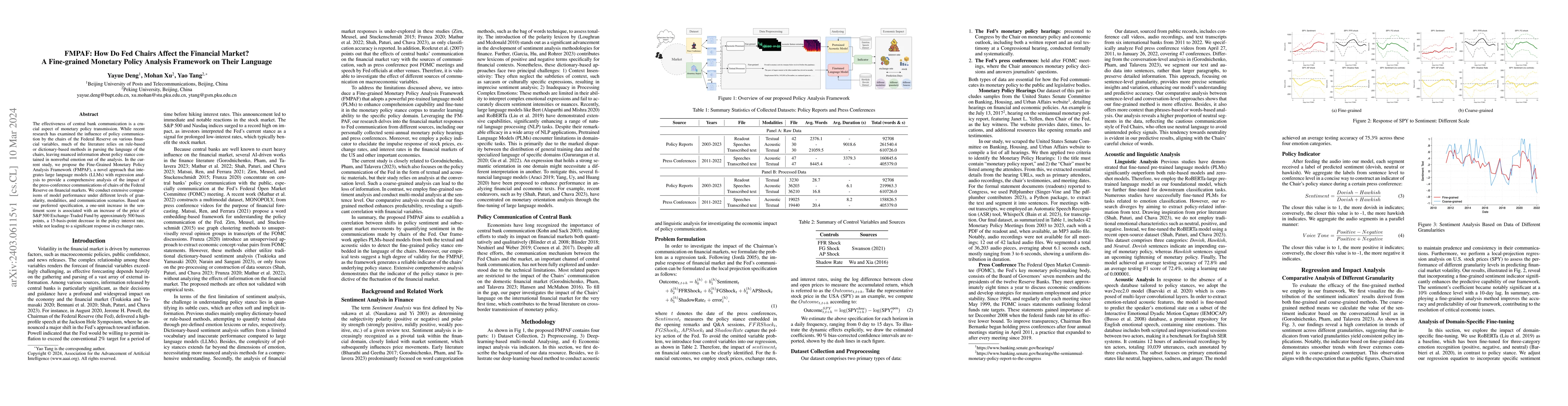

The effectiveness of central bank communication is a crucial aspect of monetary policy transmission. While recent research has examined the influence of policy communication by the chairs of the Federal Reserve on various financial variables, much of the literature relies on rule-based or dictionary-based methods in parsing the language of the chairs, leaving nuanced information about policy stance contained in nonverbal emotion out of the analysis. In the current study, we propose the Fine-Grained Monetary Policy Analysis Framework (FMPAF), a novel approach that integrates large language models (LLMs) with regression analysis to provide a comprehensive analysis of the impact of the press-conference communications of chairs of the Federal Reserve on financial markets. We conduct extensive comparisons of model performance under different levels of granularity, modalities, and communication scenarios. Based on our preferred specification, a one-unit increase in the sentiment score is associated with an increase of the price of S\&P 500 Exchange-Traded Fund by approximately 500 basis points, a 15-basis-point decrease in the policy interest rate, while not leading to a significant response in exchange rates.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWords that Move Markets- Quantifying the Impact of RBI's Monetary Policy Communications on Indian Financial Market

Nikita Singh, Rohit Kumar, Sourabh Bikas Paul

Examining the Effect of Monetary Policy and Monetary Policy Uncertainty on Cryptocurrencies Market

Mohammadreza Mahmoudi

No citations found for this paper.

Comments (0)