Summary

Credit card fraud detection (CCFD) is a critical application of Machine Learning (ML) in the financial sector, where accurately identifying fraudulent transactions is essential for mitigating financial losses. ML models have demonstrated their effectiveness in fraud detection task, in particular with the tabular dataset. While adversarial attacks have been extensively studied in computer vision and deep learning, their impacts on the ML models, particularly those trained on CCFD tabular datasets, remains largely unexplored. These latent vulnerabilities pose significant threats to the security and stability of the financial industry, especially in high-value transactions where losses could be substantial. To address this gap, in this paper, we present a holistic framework that investigate the robustness of CCFD ML model against adversarial perturbations under different circumstances. Specifically, the gradient-based attack methods are incorporated into the tabular credit card transaction data in both black- and white-box adversarial attacks settings. Our findings confirm that tabular data is also susceptible to subtle perturbations, highlighting the need for heightened awareness among financial technology practitioners regarding ML model security and trustworthiness. Furthermore, the experiments by transferring adversarial samples from gradient-based attack method to non-gradient-based models also verify our findings. Our results demonstrate that such attacks remain effective, emphasizing the necessity of developing robust defenses for CCFD algorithms.

AI Key Findings

Generated Aug 21, 2025

Methodology

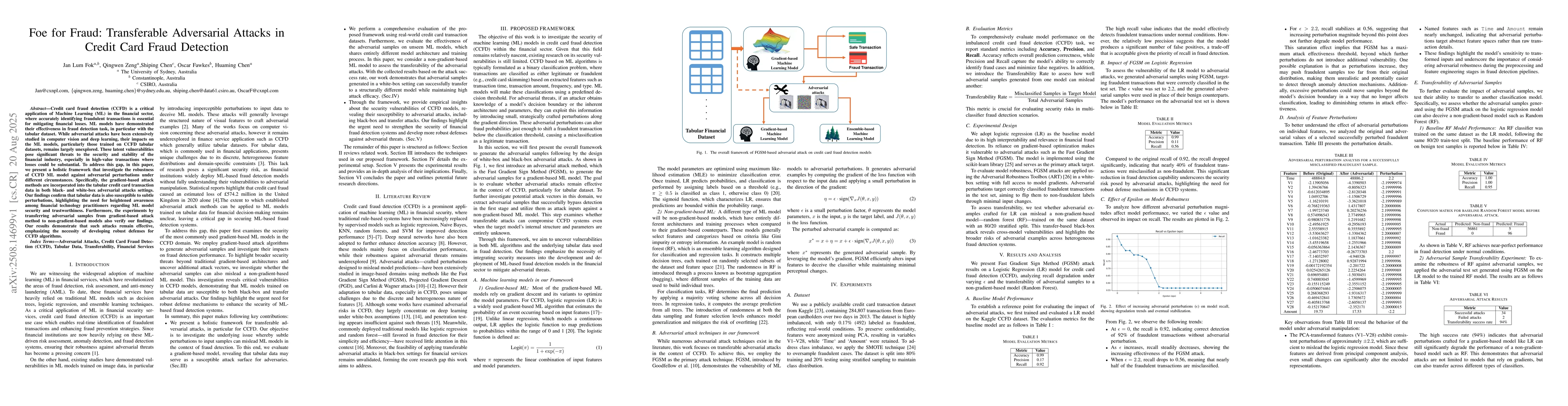

The paper presents a framework to investigate the robustness of credit card fraud detection (CCFD) ML models against adversarial perturbations using gradient-based attack methods in both black- and white-box settings on tabular credit card transaction data.

Key Results

- Tabular data is susceptible to subtle adversarial perturbations, highlighting vulnerabilities in CCFD ML models.

- Adversarial samples generated in a white-box setting can successfully transfer to structurally different models, maintaining high attack efficacy.

- Transferable adversarial attacks significantly degrade model performance, emphasizing the need for robust defenses in CCFD algorithms.

Significance

This research underscores the importance of addressing ML model security and trustworthiness in the financial industry, especially for high-value transactions where substantial losses can occur.

Technical Contribution

The paper introduces a comprehensive framework for evaluating the robustness of CCFD ML models against adversarial attacks, demonstrating the transferability of attacks across different model architectures.

Novelty

This work is novel in addressing adversarial vulnerabilities in tabular datasets used for CCFD, a largely unexplored area in ML security research.

Limitations

- The study focuses on transferable adversarial attacks and does not explore other types of attacks.

- The evaluation is limited to specific ML models (logistic regression, random forest) and may not generalize to all CCFD models.

Future Work

- Explore adversarial defense mechanisms tailored for tabular datasets.

- Investigate the effectiveness of hybrid defense strategies integrating multiple mitigation techniques.

Paper Details

PDF Preview

Similar Papers

Found 4 papersCredit Card Fraud Detection: A Deep Learning Approach

Sourav Verma, Joydip Dhar

Locally Interpretable One-Class Anomaly Detection for Credit Card Fraud Detection

Tungyu Wu, Youting Wang

Comments (0)