Authors

Summary

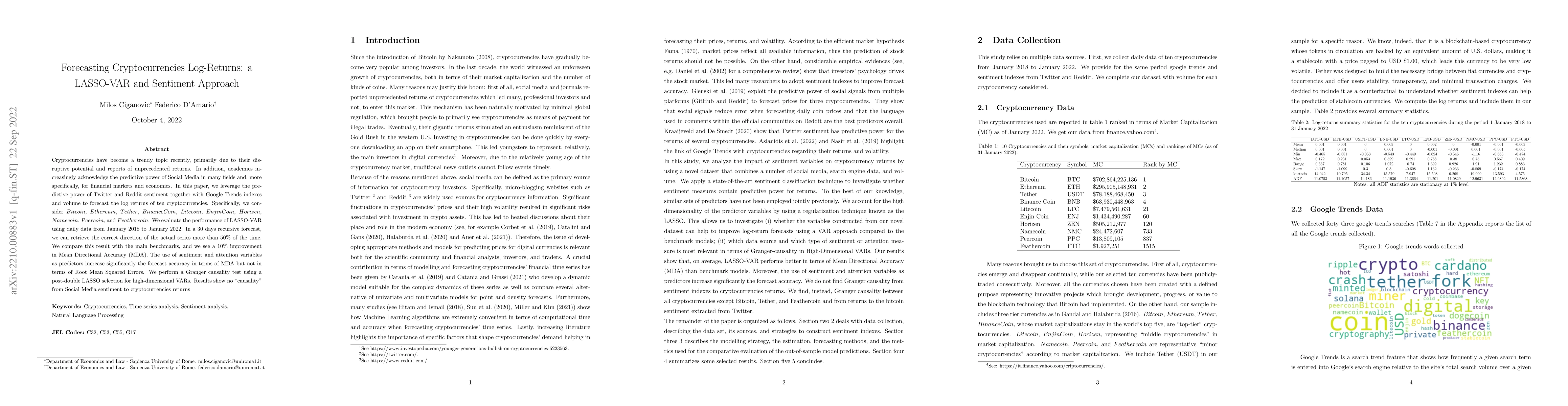

Cryptocurrencies have become a trendy topic recently, primarily due to their disruptive potential and reports of unprecedented returns. In addition, academics increasingly acknowledge the predictive power of Social Media in many fields and, more specifically, for financial markets and economics. In this paper, we leverage the predictive power of Twitter and Reddit sentiment together with Google Trends indexes and volume to forecast the log returns of ten cryptocurrencies. Specifically, we consider $Bitcoin$, $Ethereum$, $Tether$, $Binance Coin$, $Litecoin$, $Enjin Coin$, $Horizen$, $Namecoin$, $Peercoin$, and $Feathercoin$. We evaluate the performance of LASSO-VAR using daily data from January 2018 to January 2022. In a 30 days recursive forecast, we can retrieve the correct direction of the actual series more than 50% of the time. We compare this result with the main benchmarks, and we see a 10% improvement in Mean Directional Accuracy (MDA). The use of sentiment and attention variables as predictors increase significantly the forecast accuracy in terms of MDA but not in terms of Root Mean Squared Errors. We perform a Granger causality test using a post-double LASSO selection for high-dimensional VARs. Results show no "causality" from Social Media sentiment to cryptocurrencies returns

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPredicting Value at Risk for Cryptocurrencies With Generalized Random Forests

Melanie Schienle, Rebekka Buse, Konstantin Görgen

Sentiment-driven prediction of financial returns: a Bayesian-enhanced FinBERT approach

Simone Formentin, Raffaele Giuseppe Cestari

| Title | Authors | Year | Actions |

|---|

Comments (0)