Summary

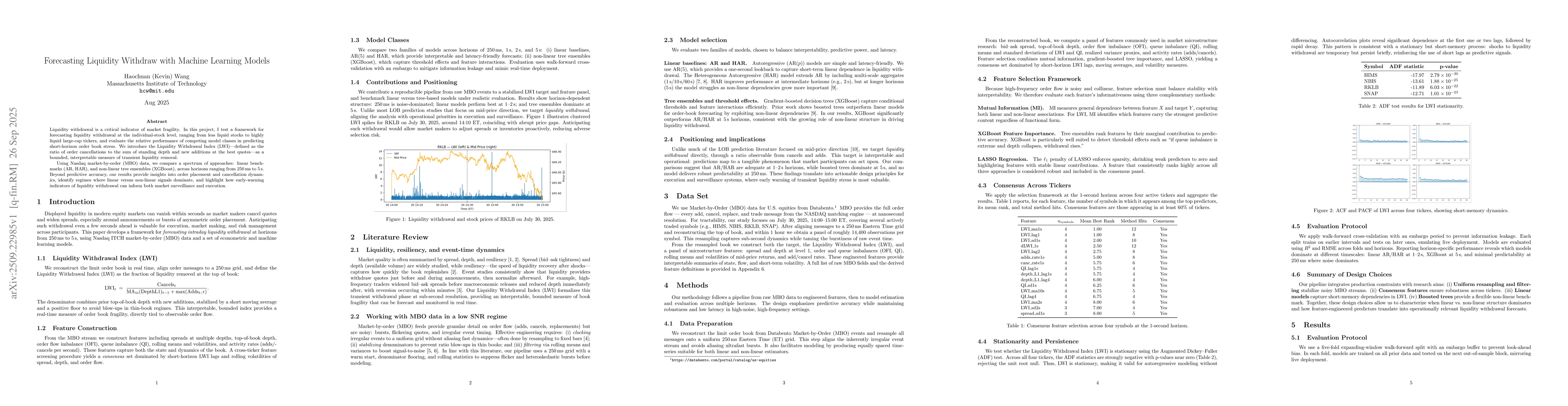

Liquidity withdrawal is a critical indicator of market fragility. In this project, I test a framework for forecasting liquidity withdrawal at the individual-stock level, ranging from less liquid stocks to highly liquid large-cap tickers, and evaluate the relative performance of competing model classes in predicting short-horizon order book stress. We introduce the Liquidity Withdrawal Index (LWI) -- defined as the ratio of order cancellations to the sum of standing depth and new additions at the best quotes -- as a bounded, interpretable measure of transient liquidity removal. Using Nasdaq market-by-order (MBO) data, we compare a spectrum of approaches: linear benchmarks (AR, HAR), and non-linear tree ensembles (XGBoost), across horizons ranging from 250\,ms to 5\,s. Beyond predictive accuracy, our results provide insights into order placement and cancellation dynamics, identify regimes where linear versus non-linear signals dominate, and highlight how early-warning indicators of liquidity withdrawal can inform both market surveillance and execution.

AI Key Findings

Generated Oct 01, 2025

Methodology

The study employs a framework combining linear models (AR, HAR) and non-linear tree ensembles (XGBoost) to forecast liquidity withdrawal using Nasdaq MBO data. It involves feature engineering, consensus selection across tickers, and walk-forward cross-validation to evaluate model performance across different time horizons.

Key Results

- XGBoost significantly outperforms AR/HAR at 5s horizons, capturing non-linear dependencies in liquidity withdrawal.

- AR/HAR models are adequate for 1–2s horizons, while XGBoost dominates at 5s, indicating regime shifts in predictive signals.

- At 250ms, no model provides robust predictability due to high noise dominance.

Significance

This research provides actionable insights for market surveillance and execution systems by identifying early-warning indicators of liquidity withdrawal, enhancing risk management and trading strategies in high-frequency environments.

Technical Contribution

Introduces the Liquidity Withdrawal Index (LWI) as a bounded, interpretable measure of transient liquidity removal and develops a robust feature selection framework combining mutual information, XGBoost importance, and LASSO.

Novelty

Directly targets liquidity withdrawal through an observable ratio from cancels and adds, offering an interpretable and operational target, unlike much of the existing literature focused on mid-price direction.

Limitations

- The study focuses on specific tickers and time periods, limiting generalizability.

- Performance at 250ms horizons is poor, suggesting challenges in ultra-short-term prediction.

Future Work

- Exploring lightweight, shallow networks or hybrid designs that maintain interpretability and low latency while extending predictive power.

- Investigating the incremental value of sequential learning beyond strong tree-based baselines in forecasting liquidity withdrawal.

Paper Details

PDF Preview

Similar Papers

Found 5 papersHigh-Frequency Trading Liquidity Analysis | Application of Machine Learning Classification

Sid Bhatia, Sidharth Peri, Sam Friedman et al.

Liquidity Jump, Liquidity Diffusion, and Portfolio of Assets with Extreme Liquidity

Qi Deng, Zhong-guo Zhou

Comments (0)