Authors

Summary

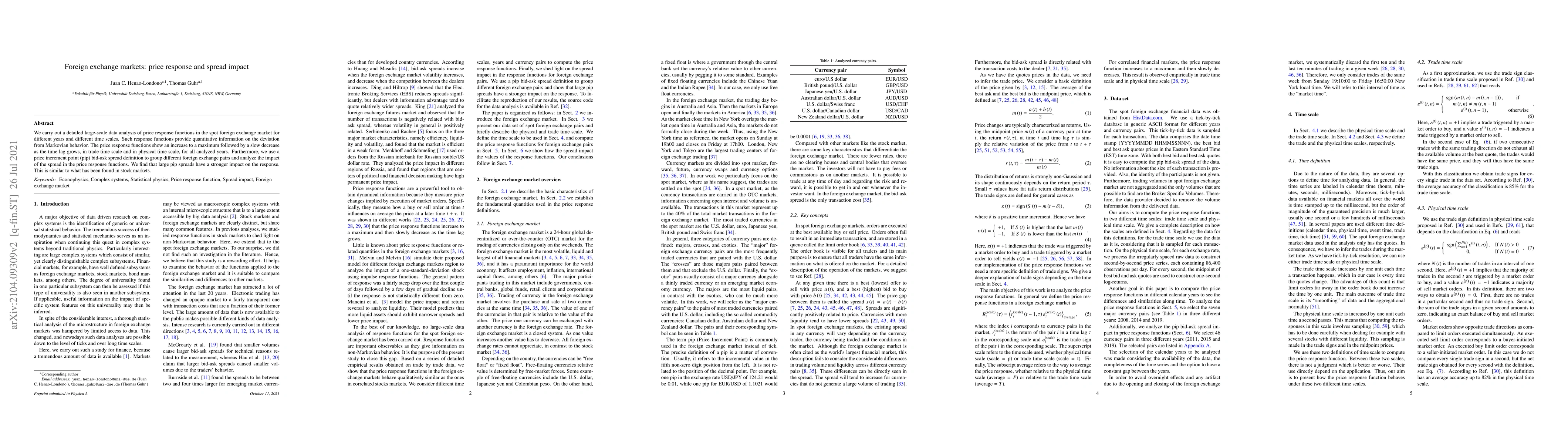

We carry out a detailed large-scale data analysis of price response functions in the spot foreign exchange market for different years and different time scales. Such response functions provide quantitative information on the deviation from Markovian behavior. The price response functions show an increase to a maximum followed by a slow decrease as the time lag grows, in trade time scale and in physical time scale, for all analyzed years. Furthermore, we use a price increment point (pip) bid-ask spread definition to group different foreign exchange pairs and analyze the impact of the spread in the price response functions. We find that large pip spreads have a stronger impact on the response. This is similar to what has been found in stock markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)