Summary

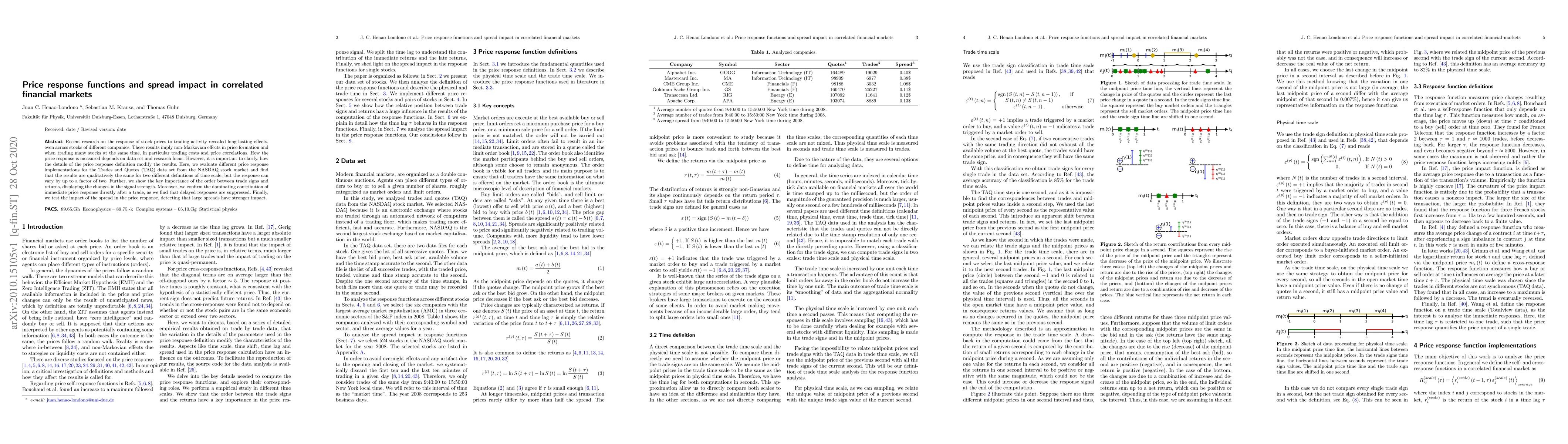

Recent research on the response of stock prices to trading activity revealed long lasting effects, even across stocks of different companies. These results imply non-Markovian effects in price formation and when trading many stocks at the same time, in particular trading costs and price correlations. How the price response is measured depends on data set and research focus. However, it is important to clarify, how the details of the price response definition modify the results. Here, we evaluate different price response implementations for the Trades and Quotes (TAQ) data set from the NASDAQ stock market and find that the results are qualitatively the same for two different definitions of time scale, but the response can vary by up to a factor of two. Further, we show the key importance of the order between trade signs and returns, displaying the changes in the signal strength. Moreover, we confirm the dominating contribution of immediate price response directly after a trade, as we find that delayed responses are suppressed. Finally, we test the impact of the spread in the price response, detecting that large spreads have stronger impact.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForeign exchange markets: price response and spread impact

Thomas Guhr, Juan Camilo Henao Londono

| Title | Authors | Year | Actions |

|---|

Comments (0)