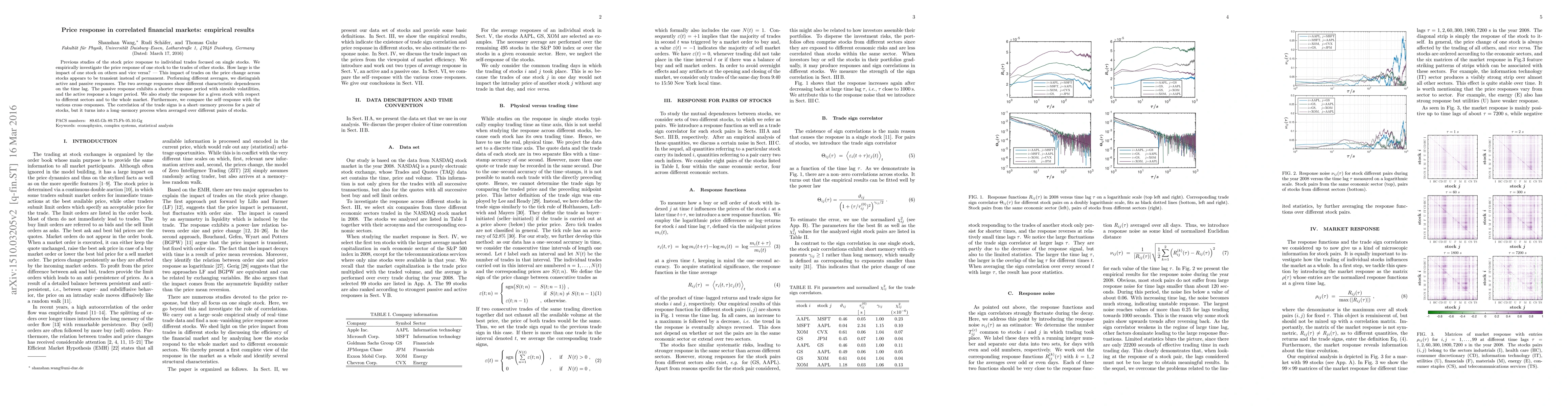

Summary

Previous studies of the stock price response to individual trades focused on single stocks. We empirically investigate the price response of one stock to the trades of other stocks. How large is the impact of one stock on others and vice versa? -- This impact of trades on the price change across stocks appears to be transient instead of permanent. Performing different averages, we distinguish active and passive responses. The two average responses show different characteristic dependences on the time lag. The passive response exhibits a shorter response period with sizeable volatilities, and the active response a longer period. We also study the response for a given stock with respect to different sectors and to the whole market. Furthermore, we compare the self-response with the various cross-responses. The correlation of the trade signs is a short-memory process for a pair of stocks, but it turns into a long-memory process when averaged over different pairs of stocks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)