Summary

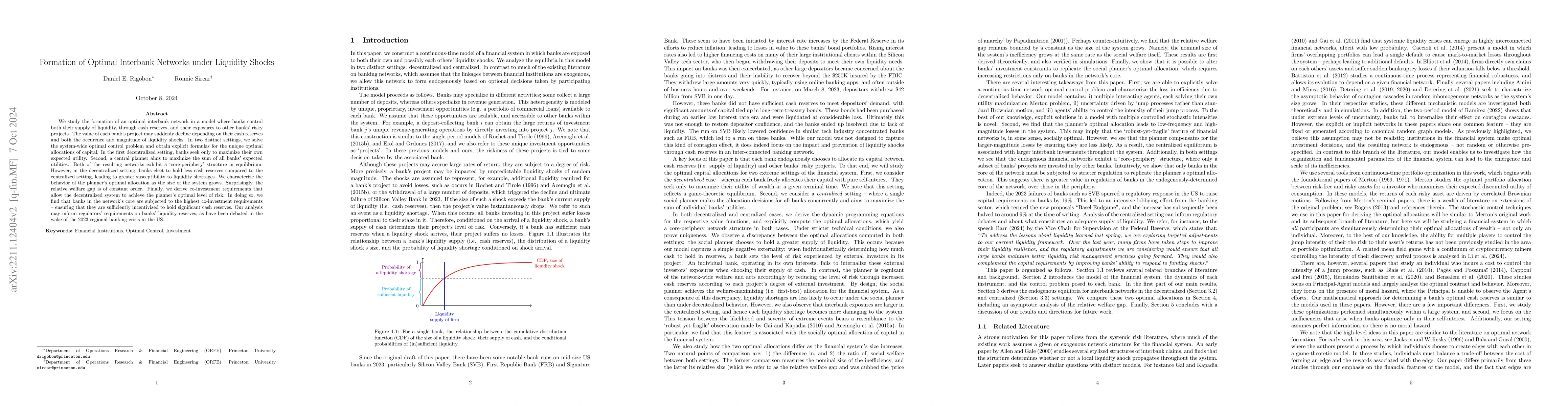

We formulate a model of the banking system in which banks control both their supply of liquidity, through cash holdings, and their exposures to risky interbank loans. The value of interbank loans jumps when banks suffer liquidity shortages, which can be caused by the arrival of large enough liquidity shocks. In two distinct settings, we compute the unique optimal allocations of capital. In the first, banks seek only to maximize their own utility -- in a decentralized manner. Second, a central planner aims to maximize the sum of all banks' utilities. Both of the resulting financial networks exhibit a `core-periphery' structure. However, the optimal allocations differ -- decentralized banks are more susceptible to liquidity shortages, while the planner ensures that banks with more debt hold greater liquidity. We characterize the behavior of the planner's optimal allocation as the size of the system grows. Surprisingly, the `price of anarchy' is of constant order. Finally, we derive capitalization requirements that cause the decentralized system to achieve the planner's level of risk. In doing so, we find that systemically important banks must face the greatest losses when they suffer liquidity crises -- ensuring that they are incentivized to avoid such crises.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)