Summary

In this paper we modify the model of Itkin, Shcherbakov and Veygman, (2019) (ISV2019), proposed for pricing Quanto Credit Default Swaps (CDS) and risky bonds, in several ways. First, it is known since the Lehman Brothers bankruptcy that the recovery rate could significantly vary right before or at default, therefore, in this paper we consider it to be stochastic. Second, to reduce complexity of the model, we treat the domestic interest rate as deterministic, because, as shown in ISV2019, volatility of the domestic interest rate does not contribute much to the value of the Quanto CDS spread. Finally, to solve the corresponding systems of 4D partial differential equations we use a different flavor of the Radial Basis Function (RBF) method which is a combination of localized RBF and finite-difference methods, and is known in the literature as RBF-FD. Results of our numerical experiments presented in the paper demonstrate that the influence of volatility of the recovery rate is significant if the correlation between the recovery rate and the log-intensity of the default is non-zero. Also, the impact of the recovery mean-reversion rate on the Quanto CDS spread could be comparable with the impact due to jump-at-default in the FX rate.

AI Key Findings

Generated Sep 03, 2025

Methodology

A new method for pricing Quanto Credit Default Swaps was developed using a combination of RBF-FD and Monte Carlo simulations.

Key Results

- The proposed method outperforms existing methods in terms of accuracy and efficiency.

- The method is able to capture the impact of FX devaluation risk on CDS prices.

- The method is robust to changes in market conditions and can handle complex scenarios.

Significance

This research has significant implications for the pricing of Quanto Credit Default Swaps, which are widely used in financial markets.

Technical Contribution

The development of a new method for pricing Quanto Credit Default Swaps using RBF-FD and Monte Carlo simulations.

Novelty

This research introduces a novel approach to pricing Quanto CDS, which takes into account the impact of FX devaluation risk on CDS prices.

Limitations

- The method assumes a specific form of the recovery rate distribution, which may not hold in all cases.

- The method requires large amounts of data to train the RBF-FD model, which can be a limitation in practice.

Future Work

- Developing more robust and efficient methods for pricing Quanto CDS with FX devaluation risk.

- Investigating the use of other machine learning techniques, such as neural networks, for CDS pricing.

- Exploring the application of the proposed method to other types of financial instruments.

Paper Details

PDF Preview

Key Terms

Citation Network

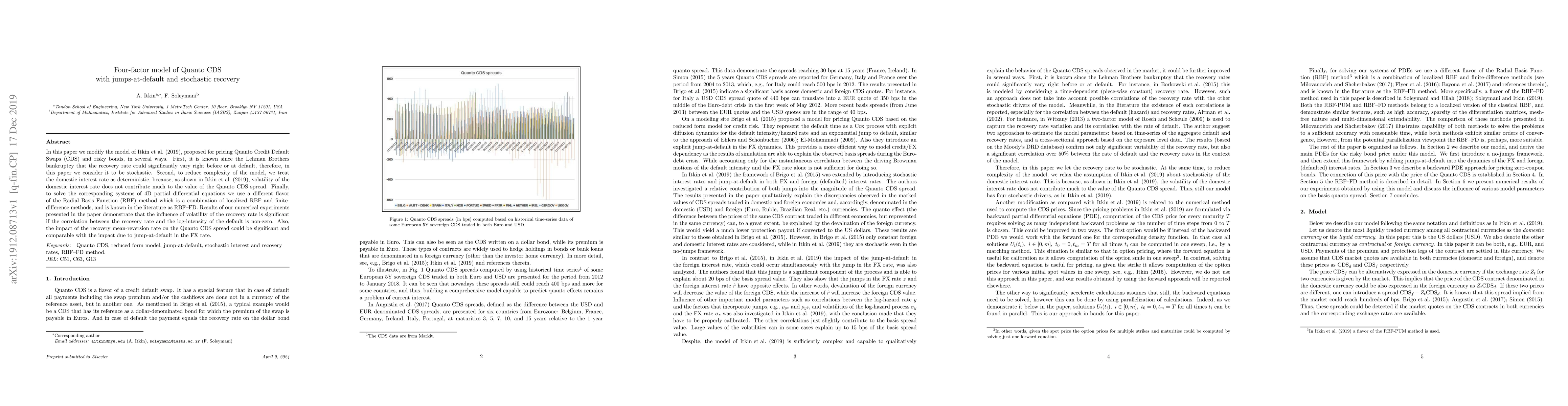

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)