Summary

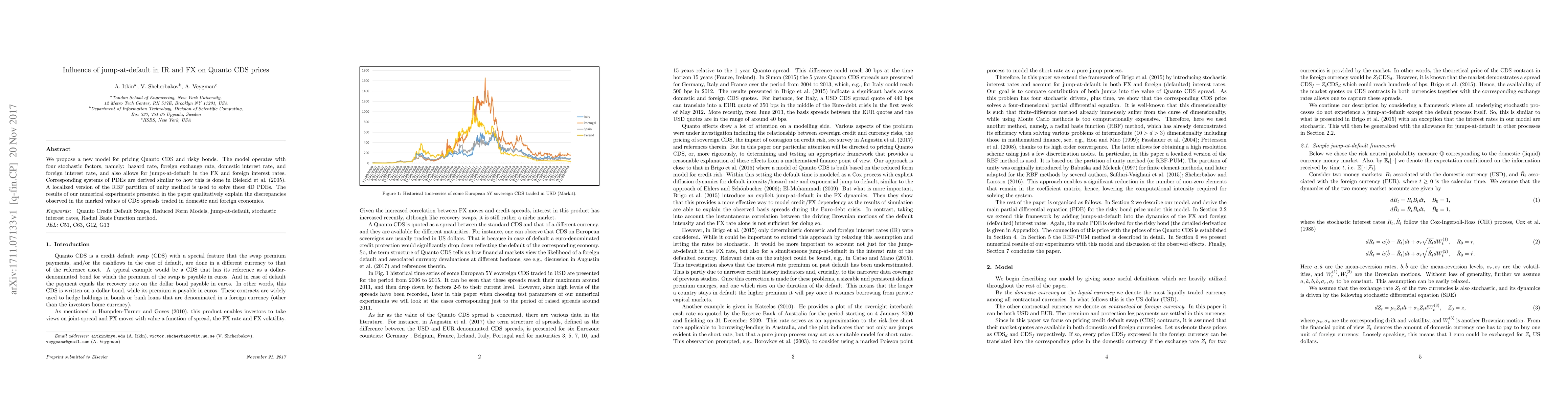

We propose a new model for pricing Quanto CDS and risky bonds. The model operates with four stochastic factors, namely: hazard rate, foreign exchange rate, domestic interest rate, and foreign interest rate, and also allows for jumps-at-default in the FX and foreign interest rates. Corresponding systems of PDEs are derived similar to how this is done in Bielecki at al., 2005. A localized version of the RBF partition of unity method is used to solve these 4D PDEs. The results of our numerical experiments presented in the paper qualitatively explain the discrepancies observed in the marked values of CDS spreads traded in domestic and foreign economies.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper proposes a new model for pricing Quanto CDS using a localized radial basis function partition of unity method, which solves systems of PDEs derived from four stochastic factors: hazard rate, foreign exchange rate, domestic interest rate, and foreign interest rate, allowing for jumps-at-default in FX and foreign interest rates.

Key Results

- A localized RBF method is developed to solve 4D PDEs with high accuracy and less computational resources.

- Numerical experiments explain discrepancies in CDS spread values traded in domestic and foreign economies.

- Quanto effect, the difference in CDS prices traded in different economies but denominated in the same currency, is largely explained by foreign currency devaluation.

- Jump-at-default in the foreign interest rate is a significant component explaining about 20 bps of the basis spread value.

- The impact of correlations and volatilities on Quanto-adjusted CDS values is analyzed, identifying key parameters for proper calibration.

Significance

This research introduces a new model for pricing Quanto CDS, offering a more accurate and efficient method compared to existing techniques, which can help financial institutions better understand and manage credit risk in multicurrency environments.

Technical Contribution

The paper presents a localized radial basis function partition of unity method for solving high-dimensional PDEs in Quanto CDS pricing, offering improved accuracy and computational efficiency compared to traditional methods.

Novelty

This work extends existing research by incorporating jumps-at-default in FX and foreign interest rates, analyzing their impact on Quanto CDS prices, and proposing an efficient numerical solution method using localized RBFs.

Limitations

- The model assumes constant foreign and domestic interest rates in some cases, which may not reflect real-world dynamics.

- The method relies on specific parameter values and correlations, requiring careful calibration for accurate results.

- The pricing problem is formulated using backward PDEs, which can be computationally intensive for large grids.

Future Work

- Explore the application of the RBF method to other financial instruments and models.

- Investigate the impact of more complex jump processes on CDS pricing.

- Develop more efficient numerical methods to solve the forward PDE for the corresponding density function.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)