Summary

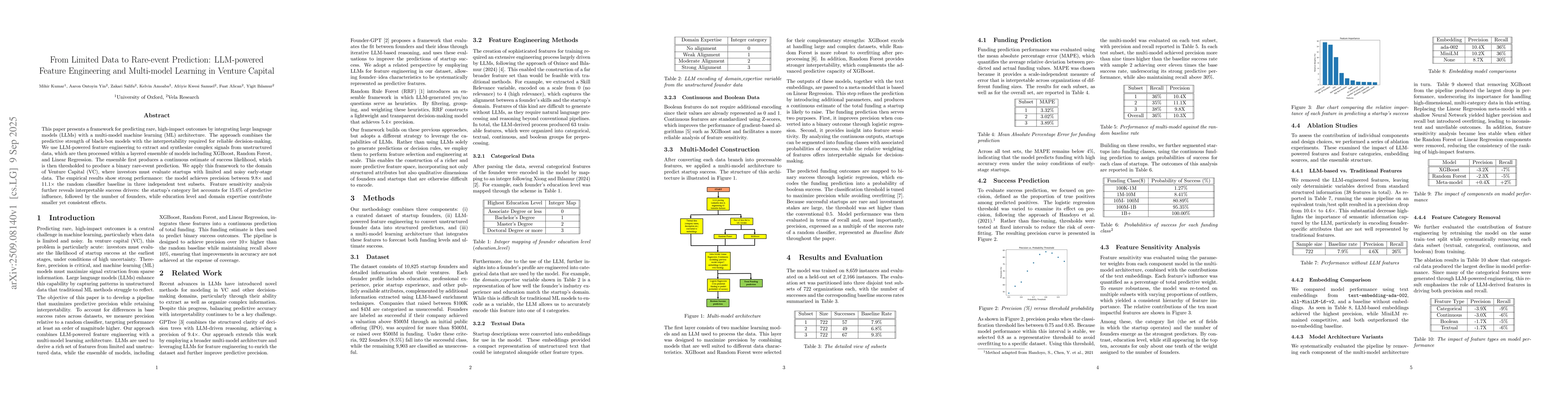

This paper presents a framework for predicting rare, high-impact outcomes by integrating large language models (LLMs) with a multi-model machine learning (ML) architecture. The approach combines the predictive strength of black-box models with the interpretability required for reliable decision-making. We use LLM-powered feature engineering to extract and synthesize complex signals from unstructured data, which are then processed within a layered ensemble of models including XGBoost, Random Forest, and Linear Regression. The ensemble first produces a continuous estimate of success likelihood, which is then thresholded to produce a binary rare-event prediction. We apply this framework to the domain of Venture Capital (VC), where investors must evaluate startups with limited and noisy early-stage data. The empirical results show strong performance: the model achieves precision between 9.8X and 11.1X the random classifier baseline in three independent test subsets. Feature sensitivity analysis further reveals interpretable success drivers: the startup's category list accounts for 15.6% of predictive influence, followed by the number of founders, while education level and domain expertise contribute smaller yet consistent effects.

AI Key Findings

Generated Nov 02, 2025

Methodology

The research combines LLM-powered feature engineering with a multi-model machine learning architecture, using XGBoost, Random Forest, and Linear Regression in an ensemble framework to predict startup success from limited and noisy data.

Key Results

- The model achieves precision 9.8X to 11.1X higher than the random classifier baseline in three test subsets.

- Feature sensitivity analysis highlights that startup category list and number of founders are the strongest predictors, contributing 15.6% and significant yet smaller effects respectively.

- Funding prediction accuracy remains below 4% MAPE, indicating robust performance even in early-stage startup conditions.

Significance

This research addresses rare-event prediction in venture capital by integrating LLMs with traditional ML models, offering both high precision and interpretability for critical investment decisions.

Technical Contribution

A novel framework that leverages LLMs for feature selection and engineering, combined with a multi-model ensemble architecture for enhanced predictive accuracy and interpretability.

Novelty

The work introduces a systematic approach to extract and encode qualitative founder and startup characteristics using LLMs, creating a richer featurespace that traditional methods cannot achieve.

Limitations

- The layered design introduces error propagation risks from funding estimates to success classification probabilities.

- LLM-derived features are subject to misclassification, especially for subjective variables like skill relevance.

Future Work

- Refining multi-model architecture to reduce error propagation through better component integration.

- Developing methods to detect and reduce hallucinations in LLM-driven feature generation for improved reliability.

Paper Details

PDF Preview

Similar Papers

Found 4 papersAutomating Venture Capital: Founder assessment using LLM-powered segmentation, feature engineering and automated labeling techniques

Ekin Ozince, Yiğit Ihlamur

Distributed VC Firms: The Next Iteration of Venture Capital

Mohib Jafri, Andy Wu

Comments (0)