Summary

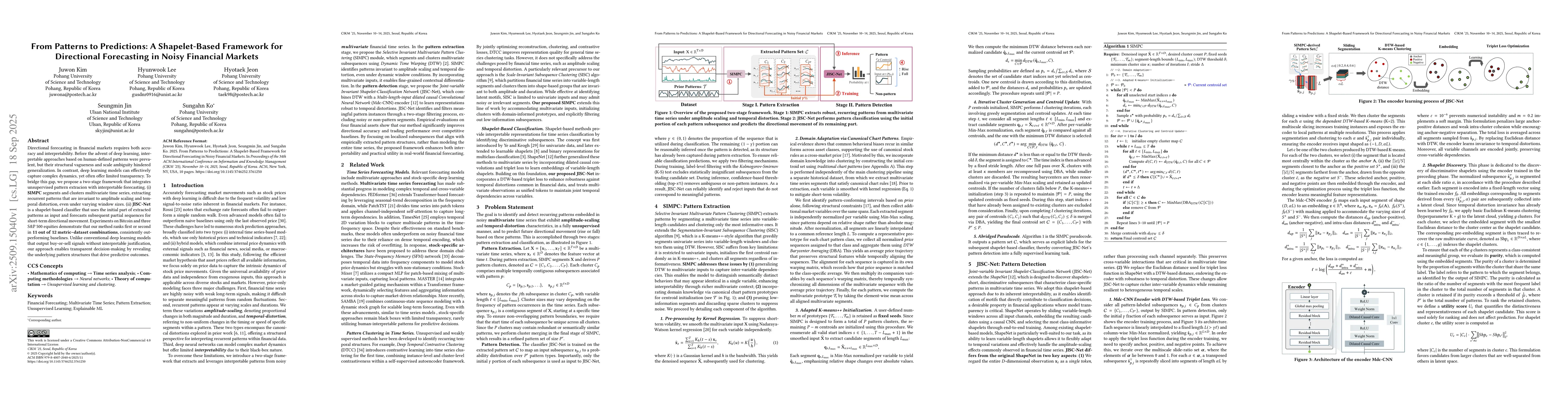

Directional forecasting in financial markets requires both accuracy and interpretability. Before the advent of deep learning, interpretable approaches based on human-defined patterns were prevalent, but their structural vagueness and scale ambiguity hindered generalization. In contrast, deep learning models can effectively capture complex dynamics, yet often offer limited transparency. To bridge this gap, we propose a two-stage framework that integrates unsupervised pattern extracion with interpretable forecasting. (i) SIMPC segments and clusters multivariate time series, extracting recurrent patterns that are invariant to amplitude scaling and temporal distortion, even under varying window sizes. (ii) JISC-Net is a shapelet-based classifier that uses the initial part of extracted patterns as input and forecasts subsequent partial sequences for short-term directional movement. Experiments on Bitcoin and three S&P 500 equities demonstrate that our method ranks first or second in 11 out of 12 metric--dataset combinations, consistently outperforming baselines. Unlike conventional deep learning models that output buy-or-sell signals without interpretable justification, our approach enables transparent decision-making by revealing the underlying pattern structures that drive predictive outcomes.

AI Key Findings

Generated Sep 30, 2025

Methodology

The research proposes a two-stage framework combining SIMPC, an unsupervised clustering method based on dynamic time warping (DTW) for discovering recurring multivariate patterns, with JISC-Net, a shapelet-based classifier that uses partial input sequences for interpretable predictions. Experiments were conducted across four asset classes to evaluate directional accuracy and trading performance.

Key Results

- The method outperformed both quantitative investment models and recent deep learning approaches in directional accuracy and trading performance.

- Two-stage filtering significantly improved prediction precision and reliability in pattern classification.

- The framework demonstrated interpretability by providing explicit insights into the pattern structures underlying trading decisions.

Significance

This research advances financial time series prediction by integrating interpretable pattern discovery with machine learning, supporting human-in-the-loop decision-making and enhancing transparency in trading strategies.

Technical Contribution

Development of a two-stage framework combining DTW-based unsupervised clustering for pattern discovery with a shapelet-based classifier for interpretable predictions in financial time series.

Novelty

The integration of dynamic time warping with shapelet-based classification for partial input sequence analysis provides novel interpretability in financial forecasting, distinguishing it from black-box deep learning approaches.

Limitations

- The method relies on DTW which can produce artificially low distances for temporally shifted but structurally dissimilar sequences.

- Pattern matching may overfit to specific historical shapes without incorporating probabilistic forecasts of future trajectories.

Future Work

- Exploring probabilistic forecasting to better capture uncertainty in future price evolution.

- Enhancing shape-aware alignment through regularization with constraints on local slopes or segment-wise curvature.

- Integrating local feature consistency checks to penalize misalignment in critical price features like reversal points.

Comments (0)