Authors

Summary

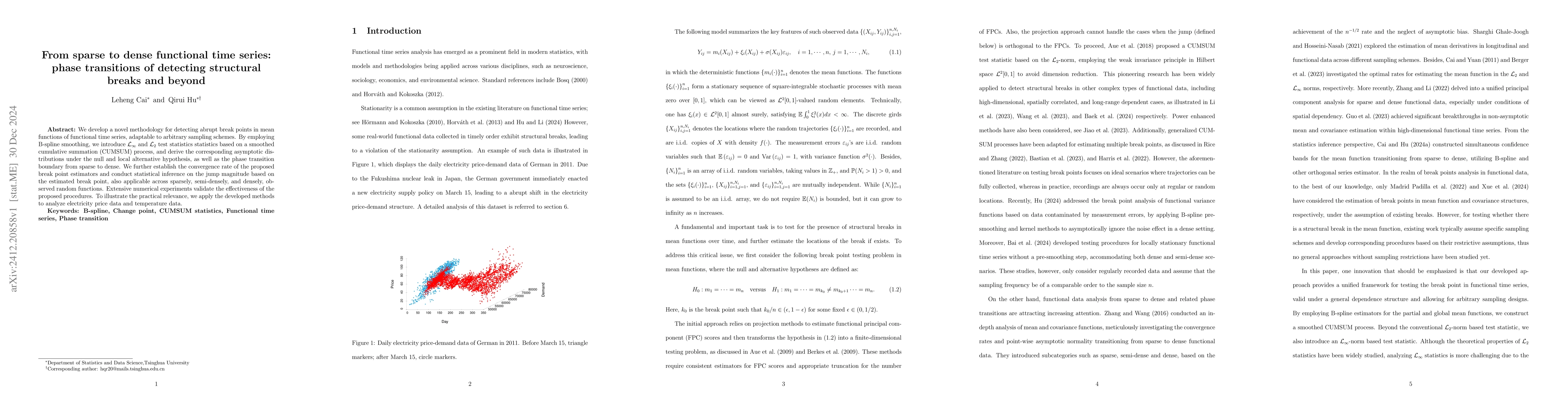

We develop a novel methodology for detecting abrupt break points in mean functions of functional time series, adaptable to arbitrary sampling schemes. By employing B-spline smoothing, we introduce $\mathcal L_{\infty}$ and $\mathcal L_2$ test statistics statistics based on a smoothed cumulative summation (CUMSUM) process, and derive the corresponding asymptotic distributions under the null and local alternative hypothesis, as well as the phase transition boundary from sparse to dense. We further establish the convergence rate of the proposed break point estimators and conduct statistical inference on the jump magnitude based on the estimated break point, also applicable across sparsely, semi-densely, and densely, observed random functions. Extensive numerical experiments validate the effectiveness of the proposed procedures. To illustrate the practical relevance, we apply the developed methods to analyze electricity price data and temperature data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersFrom Sparse to Dense Functional Data: Phase Transitions from a Simultaneous Inference Perspective

Qirui Hu, Leheng Cai

Detection and Estimation of Structural Breaks in High-Dimensional Functional Time Series

Runze Li, Han Lin Shang, Degui Li

No citations found for this paper.

Comments (0)