Authors

Summary

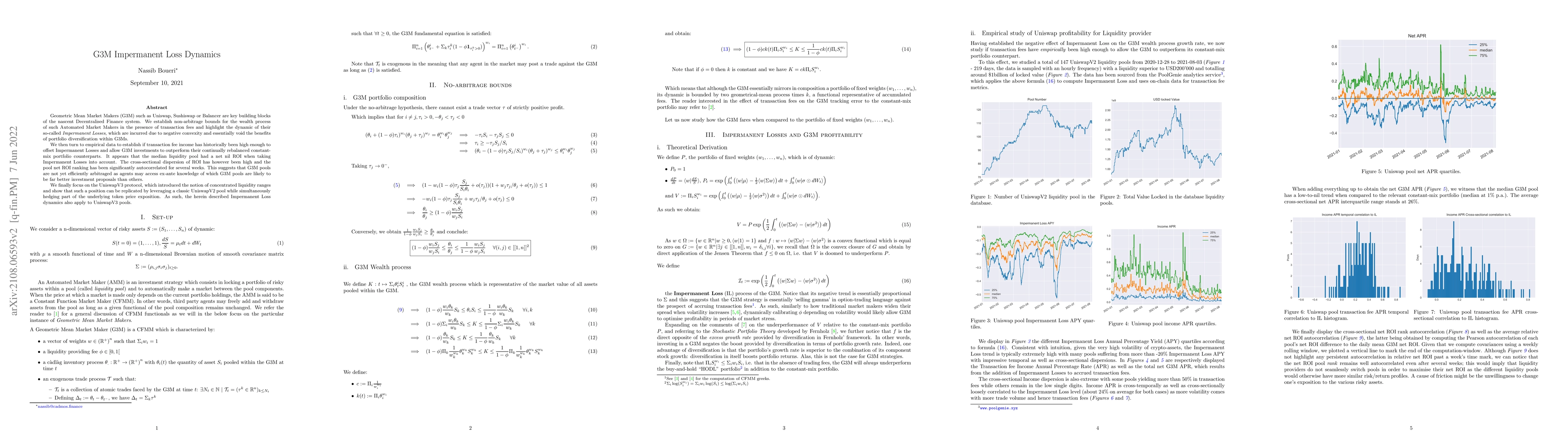

Geometric Mean Market Makers (G3M) such as Uniswap, Sushiswap or Balancer are key building blocks of the nascent Decentralised Finance system. We establish non-arbitrage bounds for the wealth process of such Automated Market Makers in the presence of transaction fees and highlight the dynamic of their so-called Impermanent Losses, which are incurred due to negative convexity and essentially void the benefits of portfolio diversification within G3Ms. We then turn to empirical data to establish if transaction fee income has historically been high enough to offset Impermanent Losses and allow G3M investments to outperform their continually rebalanced constant-mix portfolio counterparts. It appears that the median liquidity pool had a net nil ROI when taking Impermanent Losses into account. The cross-sectional dispersion of ROI has however been high and the pool net ROI ranking has been significantly autocorrelated for several weeks. This suggests that G3M pools are not yet efficiently arbitraged as agents may access ex-ante knowledge of which G3M pools are likely to be far better investment proposals than others. We finally focus on the UniswapV3 protocol, which introduced the notion of concentrated liquidity ranges and show that such a position can be replicated by leveraging a classic UniswapV2 pool while simultaneously hedging part of the underlying token price exposition. As such, the herein described Impermanent Loss dynamics also apply to UniswapV3 pools.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImpermanent loss and Loss-vs-Rebalancing II

Abe Alexander, Lars Fritz, Guillaume Lambert

A General Framework for Impermanent Loss in Automated Market Makers

Alexander Port, Neelesh Tiruviluamala, Erik Lewis

Generalizing Impermanent Loss on Decentralized Exchanges with Constant Function Market Makers

Danilo Mandic, Peter Yatsyshin, Rohan Tangri et al.

Impermanent loss and loss-vs-rebalancing I: some statistical properties

Abe Alexander, Lars Fritz

| Title | Authors | Year | Actions |

|---|

Comments (0)