Authors

Summary

We propose a parameter-free model for estimating the price or valuation of financial derivatives like options, forwards and futures using non-supervised learning networks and Monte Carlo. Although some arbitrage-based pricing formula performs greatly on derivatives pricing like Black-Scholes on option pricing, generative model-based Monte Carlo estimation(GAN-MC) will be more accurate and holds more generalizability when lack of training samples on derivatives, underlying asset's price dynamics are unknown or the no-arbitrage conditions can not be solved analytically. We analyze the variance reduction feature of our model and to validate the potential value of the pricing model, we collect real world market derivatives data and show that our model outperforms other arbitrage-based pricing models and non-parametric machine learning models. For comparison, we estimate the price of derivatives using Black-Scholes model, ordinary least squares, radial basis function networks, multilayer perception regression, projection pursuit regression and Monte Carlo only models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

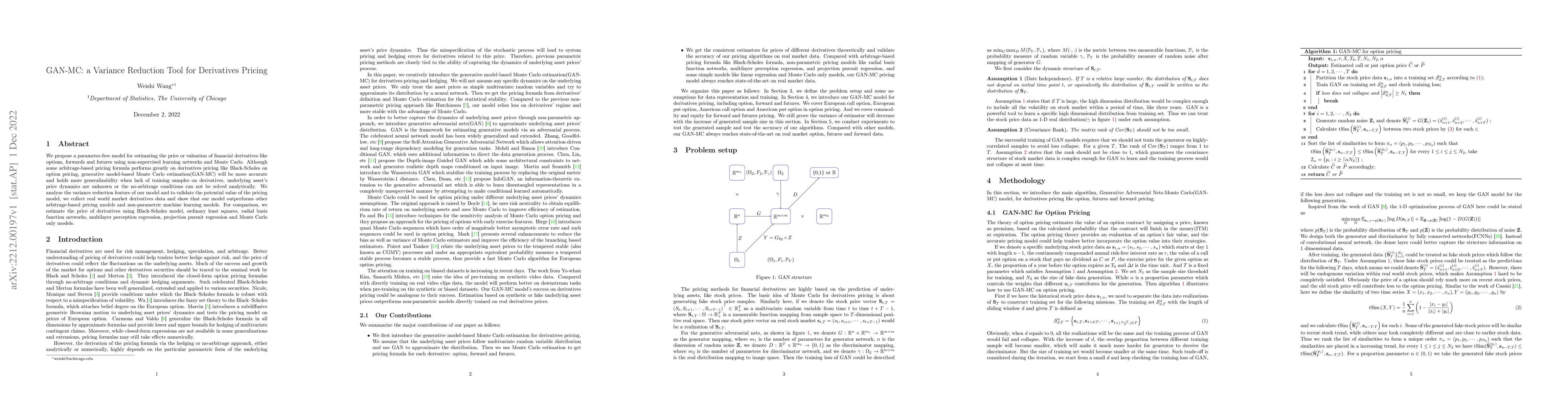

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOption Pricing for the Variance Gamma Model: A New Perspective

Haixu Wang, Yuanda Chen, Zailei Cheng

No citations found for this paper.

Comments (0)