Summary

Consider a risk portfolio with aggregate loss random variable $S=X_1+\dots +X_n$ defined as the sum of the $n$ individual losses $X_1, \dots, X_n$. The expected allocation, $E[X_i \times 1_{\{S = k\}}]$, for $i = 1, \dots, n$ and $k \in \mathbb{N}$, is a vital quantity for risk allocation and risk-sharing. For example, one uses this value to compute peer-to-peer contributions under the conditional mean risk-sharing rule and capital allocated to a line of business under the Euler risk allocation paradigm. This paper introduces an ordinary generating function for expected allocations, a power series representation of the expected allocation of an individual risk given the total risks in the portfolio when all risks are discrete. First, we provide a simple relationship between the ordinary generating function for expected allocations and the probability generating function. Then, leveraging properties of ordinary generating functions, we reveal new theoretical results on closed-formed solutions to risk allocation problems, especially when dealing with Katz or compound Katz distributions. Then, we present an efficient algorithm to recover the expected allocations using the fast Fourier transform, providing a new practical tool to compute expected allocations quickly. The latter approach is exceptionally efficient for a portfolio of independent risks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

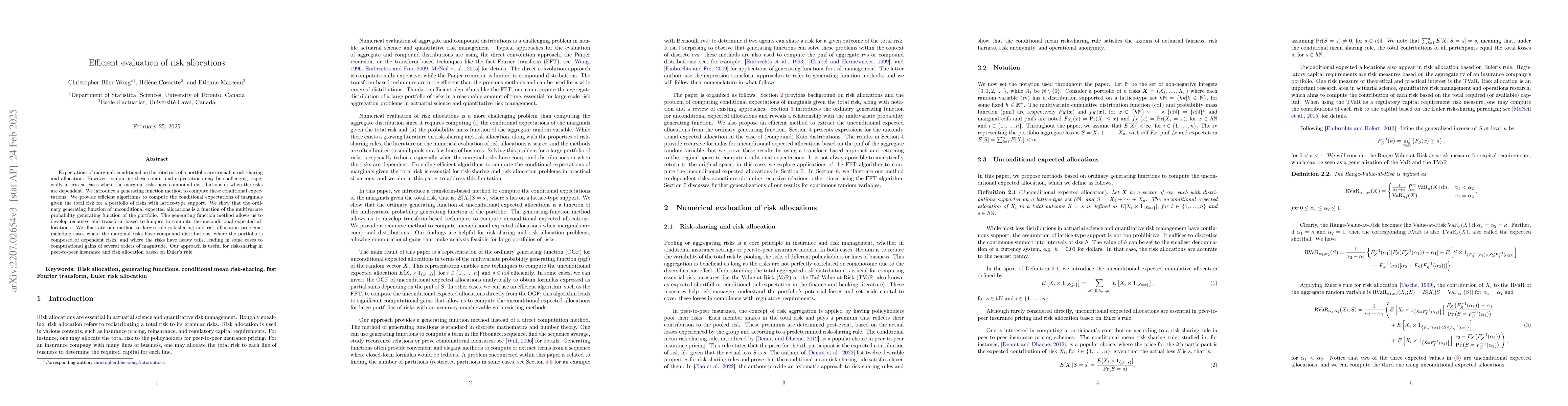

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForecasting and Backtesting Gradient Allocations of Expected Shortfall

Takaaki Koike, Cathy W. S. Chen, Edward M. H. Lin

| Title | Authors | Year | Actions |

|---|

Comments (0)