Summary

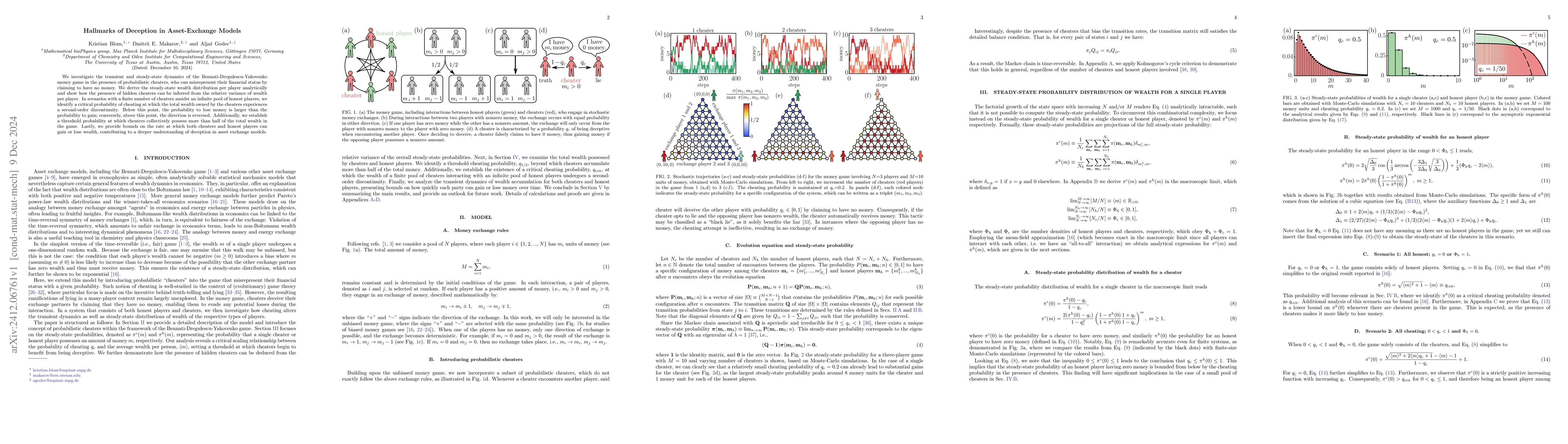

We investigate the transient and steady-state dynamics of the Bennati-Dregulescu-Yakovenko money game in the presence of probabilistic cheaters, who can misrepresent their financial status by claiming to have no money. We derive the steady-state wealth distribution per player analytically and show how the presence of hidden cheaters can be inferred from the relative variance of wealth per player. In scenarios with a finite number of cheaters amidst an infinite pool of honest players, we identify a critical probability of cheating at which the total wealth owned by the cheaters experiences a second-order discontinuity. Below this point, the probability to lose money is larger than the probability to gain; conversely, above this point, the direction is reversed. Additionally, we establish a threshold probability at which cheaters collectively possess more than half of the total wealth in the game. Lastly, we provide bounds on the rate at which both cheaters and honest players can gain or lose wealth, contributing to a deeper understanding of deception in asset exchange models.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research investigates the transient and steady-state dynamics of the Bennati-Dregulescu-Yakovenko (BDY) money game with probabilistic cheaters who can misrepresent their financial status. Analytical derivations are used to find the steady-state wealth distribution per player and to identify critical probabilities for cheater behavior.

Key Results

- Derivation of the steady-state wealth distribution per player for both cheaters and honest players.

- Identification of a critical probability of cheating (qc_crit) where total wealth owned by cheaters experiences a second-order discontinuity.

- Threshold probability at which cheaters collectively possess more than half of the total wealth.

- Bounds on the rate at which both cheaters and honest players can gain or lose wealth.

- Method to detect hidden cheaters from the steady-state distribution of wealth per player.

Significance

This study contributes to a deeper understanding of deception in asset exchange models, providing insights into how probabilistic cheating affects wealth distribution and offering methods for detecting hidden cheaters in financial systems.

Technical Contribution

Analytical derivations for steady-state wealth distributions in the presence of probabilistic cheaters, along with methods for detecting hidden cheaters based on relative variance of wealth per player.

Novelty

The paper extends previous BDY models by incorporating probabilistic cheating, revealing critical scaling of cheating probability with total wealth and providing a novel method for detecting hidden cheaters through relative variance analysis.

Limitations

- The model assumes an infinite pool of honest players and a finite number of cheaters.

- Real-world applications may involve more complex dynamics not captured by this simplified model.

Future Work

- Investigate the impact of different types of cheating strategies on wealth distribution.

- Explore the introduction of penalties for cheating and their effect on deception strategies.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)