Summary

Despite the impressive success of deep neural networks in many application areas, neural network models have so far not been widely adopted in the context of volatility forecasting. In this work, we aim to bridge the conceptual gap between established time series approaches, such as the Heterogeneous Autoregressive (HAR) model, and state-of-the-art deep neural network models. The newly introduced HARNet is based on a hierarchy of dilated convolutional layers, which facilitates an exponential growth of the receptive field of the model in the number of model parameters. HARNets allow for an explicit initialization scheme such that before optimization, a HARNet yields identical predictions as the respective baseline HAR model. Particularly when considering the QLIKE error as a loss function, we find that this approach significantly stabilizes the optimization of HARNets. We evaluate the performance of HARNets with respect to three different stock market indexes. Based on this evaluation, we formulate clear guidelines for the optimization of HARNets and show that HARNets can substantially improve upon the forecasting accuracy of their respective HAR baseline models. In a qualitative analysis of the filter weights learnt by a HARNet, we report clear patterns regarding the predictive power of past information. Among information from the previous week, yesterday and the day before, yesterday's volatility makes by far the most contribution to today's realized volatility forecast. Moroever, within the previous month, the importance of single weeks diminishes almost linearly when moving further into the past.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

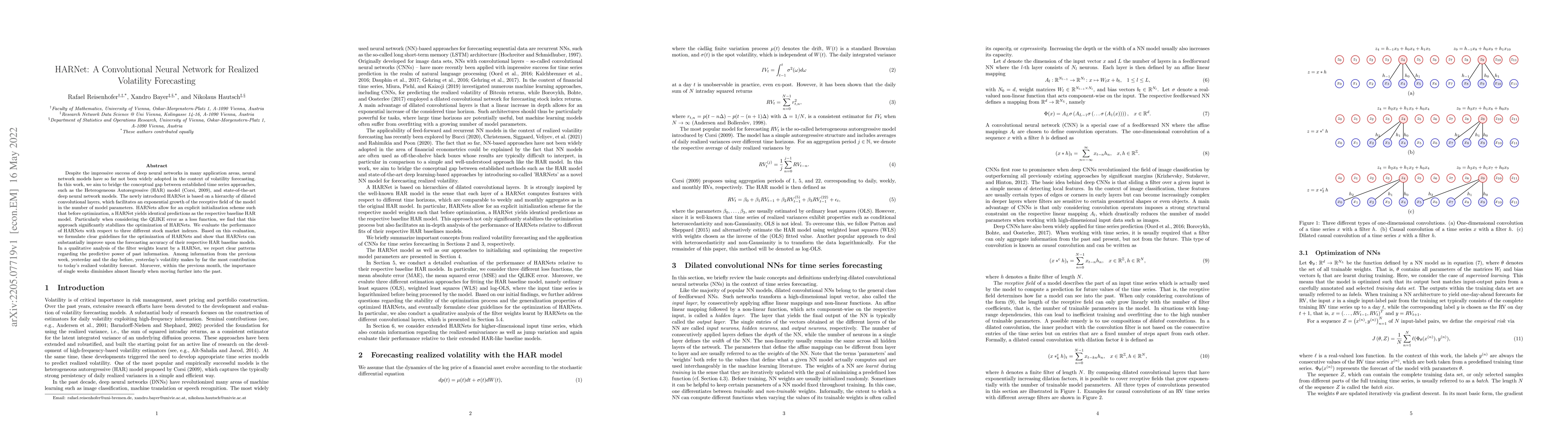

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultivariate Realized Volatility Forecasting with Graph Neural Network

Christian-Yann Robert, Qinkai Chen

Quantum Reservoir Computing for Realized Volatility Forecasting

Abolfazl Bayat, Qingyu Li, Ali Habibnia et al.

Graph Neural Networks for Forecasting Multivariate Realized Volatility with Spillover Effects

Chao Zhang, Mihai Cucuringu, Xiaowen Dong et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)