Summary

Renewable generators must commit to day-ahead market bids despite uncertainty in both production and real-time prices. While forecasts provide valuable guidance, rare and unpredictable extreme events (so-called black swans) can cause substantial financial losses. This paper models the nomination problem as an instance of optimal transport-based distributionally robust optimization (OT-DRO), a principled framework that balances risk and performance by accounting not only for the severity of deviations but also for their likelihood. The resulting formulation yields a tractable, data-driven strategy that remains competitive under normal conditions while providing effective protection against extreme price spikes. Using four years of Finnish wind farm and market data, we demonstrate that OT-DRO consistently outperforms forecast-based nominations and significantly mitigates losses during black swan events.

AI Key Findings

Generated Oct 20, 2025

Methodology

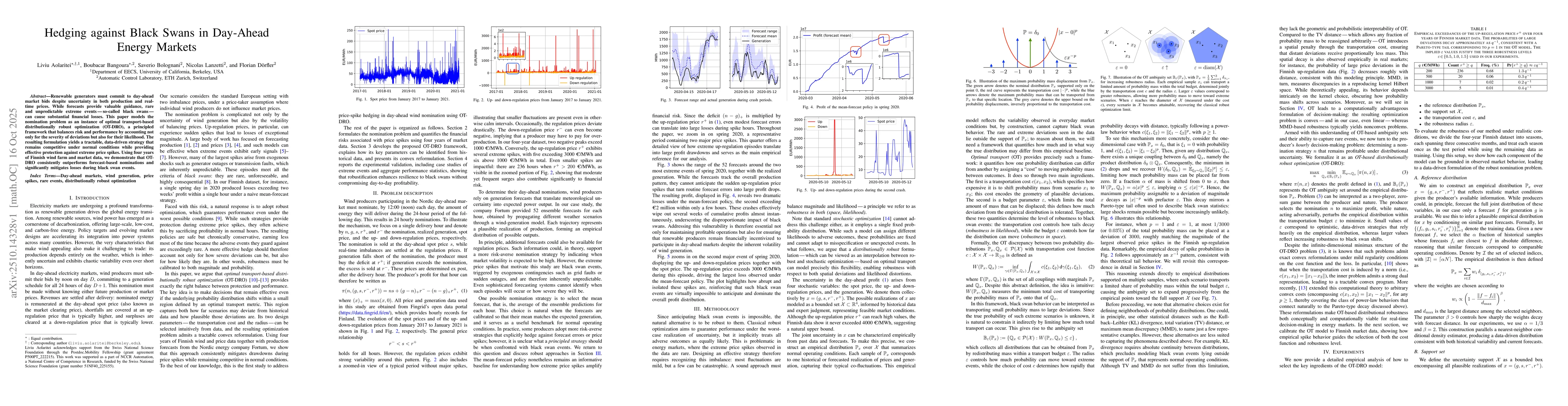

The research employs an optimal transport (OT) framework to model distributional robustness in energy markets, combining probabilistic constraints with convex optimization techniques to derive robust nomination strategies under uncertain price deviations.

Key Results

- The OT-based approach successfully captures heavy-tailed price behavior through Pareto-like tail distributions, aligning with empirical observations from Finnish energy markets.

- Robustness radii ε are calibrated using exceedance probabilities, demonstrating that smaller ε values correspond to tighter constraints on extreme price deviations.

- Convex reformulations enable efficient computation of optimal nominations, maintaining robustness guarantees without requiring rescaling of transport costs.

Significance

This work provides a novel framework for managing distributional uncertainty in energy markets, offering practical tools for risk-averse decision-making in electricity trading and grid operations.

Technical Contribution

A convex reformulation of the OT-robust optimization problem using piecewise linear profit representations and dual variables, enabling efficient computation of robust nominations.

Novelty

This work introduces a direct mapping between empirical tail behavior and transport budgets, providing a data-driven method for calibrating robustness parameters in distributionally robust optimization.

Limitations

- The methodology assumes independent price deviations, which may not hold in highly correlated market conditions.

- Empirical validation is limited to Finnish data, requiring further testing in diverse market environments.

Future Work

- Extending the framework to handle correlated price variables and multi-market scenarios

- Investigating the integration of real-time market data for dynamic robustness calibration

- Exploring applications in renewable energy integration and demand response management

Paper Details

PDF Preview

Similar Papers

Found 5 papersNash Equilibrium of Joint Day-ahead Electricity Markets and Forward Contracts in Congested Power Systems

Henrik Madsen, Mohsen Banaei, Razgar Ebrahimy et al.

Rolling intrinsic for battery valuation in day-ahead and intraday markets

Daniel Oeltz, Tobias Pfingsten

Day-Ahead Programming of Energy Communities Participating in Pay-as-Bid Service Markets

F. Conte, S. Massucco, G. Natrella et al.

Comments (0)