Summary

We consider a semimartingale market model when the underlying diffusion has a singular volatility matrix and compute the hedging portfolio for a given payoff function. Recently, the representation problem for such degenerate diffusions with respect to a minimal martingale has been completely settled. This martingale representation and Malliavin calculus established further for the functionals of a degenerate diffusion process constitute the basis of the present work. Using the Clark-Hausmann-Bismut-Ocone type representation formula derived for these functionals, we prove a version of this formula under an equivalent martingale measure. This allows us to derive the hedging portfolio as a solution of a system of linear equations. The uniqueness of the solution is achieved by a projection idea that lies at the core of the martingale representation at the first place. We demonstrate the hedging strategy as explicitly as possible with some examples of the payoff function such as those used in exotic options, whose value at maturity depends on the prices over the entire time horizon.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

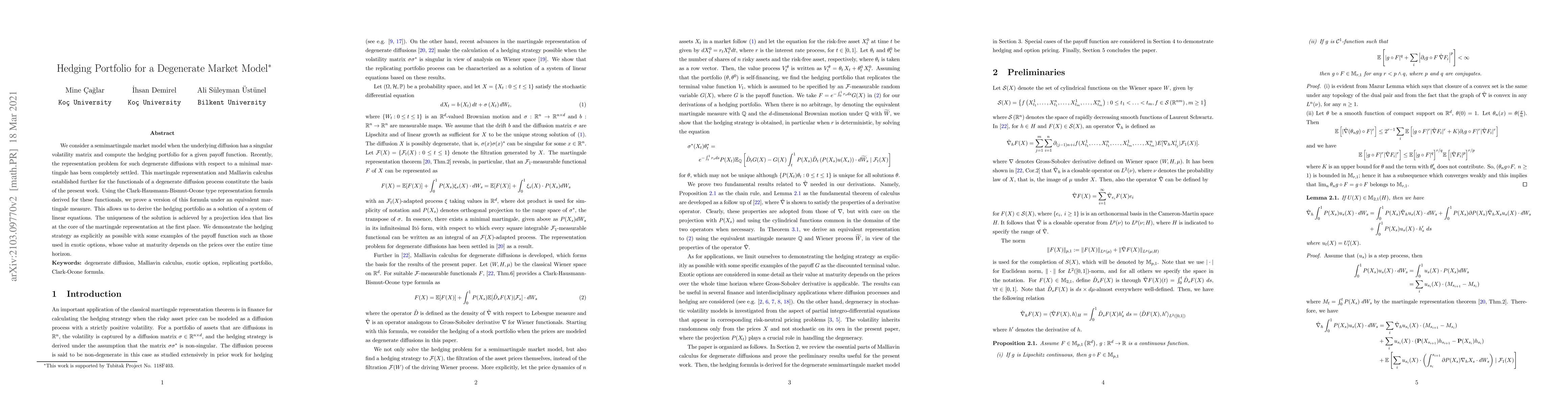

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Hedging with Market Impact

Frédéric Godin, Leila Kosseim, Andrei Neagu et al.

Model-Free Market Risk Hedging Using Crowding Networks

Jiayu Liu, Fei He, Igor Halperin et al.

Deep learning for quadratic hedging in incomplete jump market

Nacira Agram, Bernt Øksendal, Jan Rems

No citations found for this paper.

Comments (0)