Summary

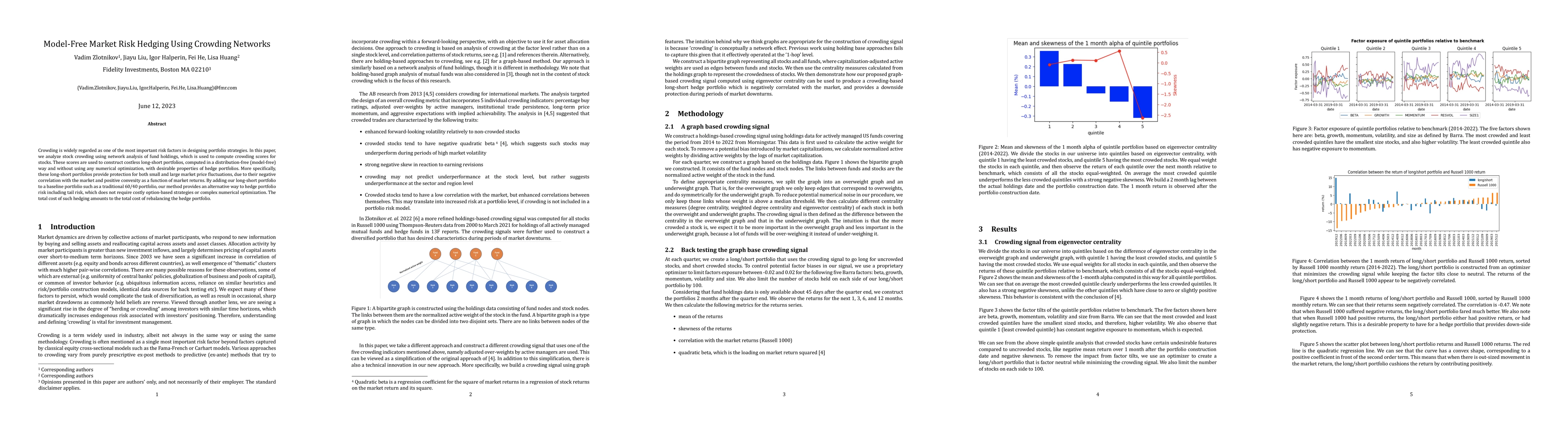

Crowding is widely regarded as one of the most important risk factors in designing portfolio strategies. In this paper, we analyze stock crowding using network analysis of fund holdings, which is used to compute crowding scores for stocks. These scores are used to construct costless long-short portfolios, computed in a distribution-free (model-free) way and without using any numerical optimization, with desirable properties of hedge portfolios. More specifically, these long-short portfolios provide protection for both small and large market price fluctuations, due to their negative correlation with the market and positive convexity as a function of market returns. By adding our long-short portfolio to a baseline portfolio such as a traditional 60/40 portfolio, our method provides an alternative way to hedge portfolio risk including tail risk, which does not require costly option-based strategies or complex numerical optimization. The total cost of such hedging amounts to the total cost of rebalancing the hedge portfolio.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHedging option books using neural-SDE market models

Sheng Wang, Christoph Reisinger, Samuel N. Cohen

Deep Hedging with Market Impact

Frédéric Godin, Leila Kosseim, Andrei Neagu et al.

No citations found for this paper.

Comments (0)