Authors

Summary

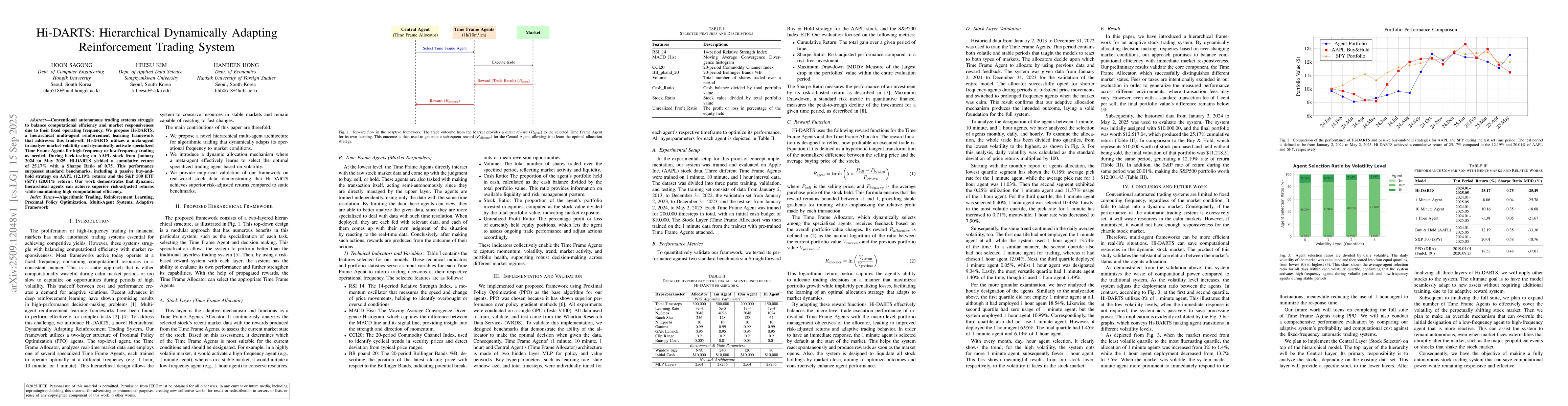

Conventional autonomous trading systems struggle to balance computational efficiency and market responsiveness due to their fixed operating frequency. We propose Hi-DARTS, a hierarchical multi-agent reinforcement learning framework that addresses this trade-off. Hi-DARTS utilizes a meta-agent to analyze market volatility and dynamically activate specialized Time Frame Agents for high-frequency or low-frequency trading as needed. During back-testing on AAPL stock from January 2024 to May 2025, Hi-DARTS yielded a cumulative return of 25.17% with a Sharpe Ratio of 0.75. This performance surpasses standard benchmarks, including a passive buy-and-hold strategy on AAPL (12.19% return) and the S&P 500 ETF (SPY) (20.01% return). Our work demonstrates that dynamic, hierarchical agents can achieve superior risk-adjusted returns while maintaining high computational efficiency.

AI Key Findings

Generated Oct 02, 2025

Methodology

Hi-DARTS employs a hierarchical multi-agent reinforcement learning framework with a meta-agent (CentralAgent) that dynamically selects specialized TimeFrameAgents (1m/10m/1h) based on market volatility. The system uses Proximal Policy Optimization (PPO) for training and evaluates performance using cumulative return, Sharpe Ratio, and Maximum Drawdown metrics.

Key Results

- Hi-DARTS achieved a 25.17% cumulative return on AAPL stock from 2024-2025, outperforming the buy-and-hold strategy (12.19%) and S&P 500 ETF (20.01%).

- The system dynamically allocates between high-frequency (1m) and low-frequency (1h) agents based on market volatility, with 1m agents used more during volatile periods.

- The Sharpe Ratio of 0.75 indicates better risk-adjusted returns compared to standard benchmarks.

Significance

This research demonstrates that adaptive, hierarchical reinforcement learning can enhance trading performance by balancing computational efficiency and market responsiveness, offering a scalable solution for dynamic financial markets.

Technical Contribution

The paper introduces a hierarchical reinforcement learning framework with dynamic agent allocation, combining technical indicators and portfolio metrics for improved decision-making across different market regimes.

Novelty

Hi-DARTS introduces a dynamically adapting hierarchical multi-agent system that optimizes both micro-level trade execution and macro-level portfolio management through adaptive reward functions and real-time market responsiveness.

Limitations

- The study excludes transaction fees and taxes, which may affect real-world performance.

- Performance is evaluated on AAPL stock data, limiting generalizability to other assets.

Future Work

- Implement the CentralLayer (StockSelector) to analyze stocks and select optimal assets for lower layers.

- Expand the number of TimeFrameAgents to cover broader market volatility ranges.

- Develop an override mechanism to switch between agent types during sudden market shocks.

Paper Details

PDF Preview

Similar Papers

Found 4 papersEarnHFT: Efficient Hierarchical Reinforcement Learning for High Frequency Trading

Wentao Zhang, Shuo Sun, Haochong Xia et al.

Select and Trade: Towards Unified Pair Trading with Hierarchical Reinforcement Learning

Jimin Huang, Qianqian Xie, Min Peng et al.

EM-DARTS: Hierarchical Differentiable Architecture Search for Eye Movement Recognition

Xinbo Gao, Xin Jin, Xin Yu et al.

Comments (0)