Authors

Summary

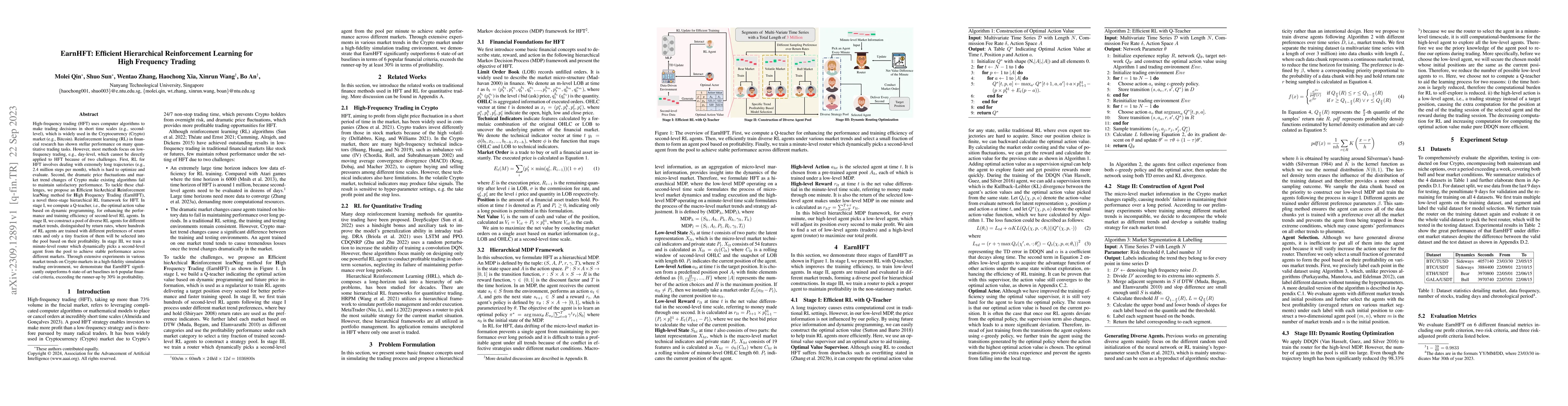

High-frequency trading (HFT) uses computer algorithms to make trading decisions in short time scales (e.g., second-level), which is widely used in the Cryptocurrency (Crypto) market (e.g., Bitcoin). Reinforcement learning (RL) in financial research has shown stellar performance on many quantitative trading tasks. However, most methods focus on low-frequency trading, e.g., day-level, which cannot be directly applied to HFT because of two challenges. First, RL for HFT involves dealing with extremely long trajectories (e.g., 2.4 million steps per month), which is hard to optimize and evaluate. Second, the dramatic price fluctuations and market trend changes of Crypto make existing algorithms fail to maintain satisfactory performance. To tackle these challenges, we propose an Efficient hieArchical Reinforcement learNing method for High Frequency Trading (EarnHFT), a novel three-stage hierarchical RL framework for HFT. In stage I, we compute a Q-teacher, i.e., the optimal action value based on dynamic programming, for enhancing the performance and training efficiency of second-level RL agents. In stage II, we construct a pool of diverse RL agents for different market trends, distinguished by return rates, where hundreds of RL agents are trained with different preferences of return rates and only a tiny fraction of them will be selected into the pool based on their profitability. In stage III, we train a minute-level router which dynamically picks a second-level agent from the pool to achieve stable performance across different markets. Through extensive experiments in various market trends on Crypto markets in a high-fidelity simulation trading environment, we demonstrate that EarnHFT significantly outperforms 6 state-of-art baselines in 6 popular financial criteria, exceeding the runner-up by 30% in profitability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Reinforcement Learning for Active High Frequency Trading

Antonio Briola, Tomaso Aste, Alvaro Cauderan et al.

MacroHFT: Memory Augmented Context-aware Reinforcement Learning On High Frequency Trading

Lei Feng, Molei Qin, Chuqiao Zong et al.

Hi-DARTS: Hierarchical Dynamically Adapting Reinforcement Trading System

Heesu Kim, Hoon Sagong, Hanbeen Hong

| Title | Authors | Year | Actions |

|---|

Comments (0)