Authors

Summary

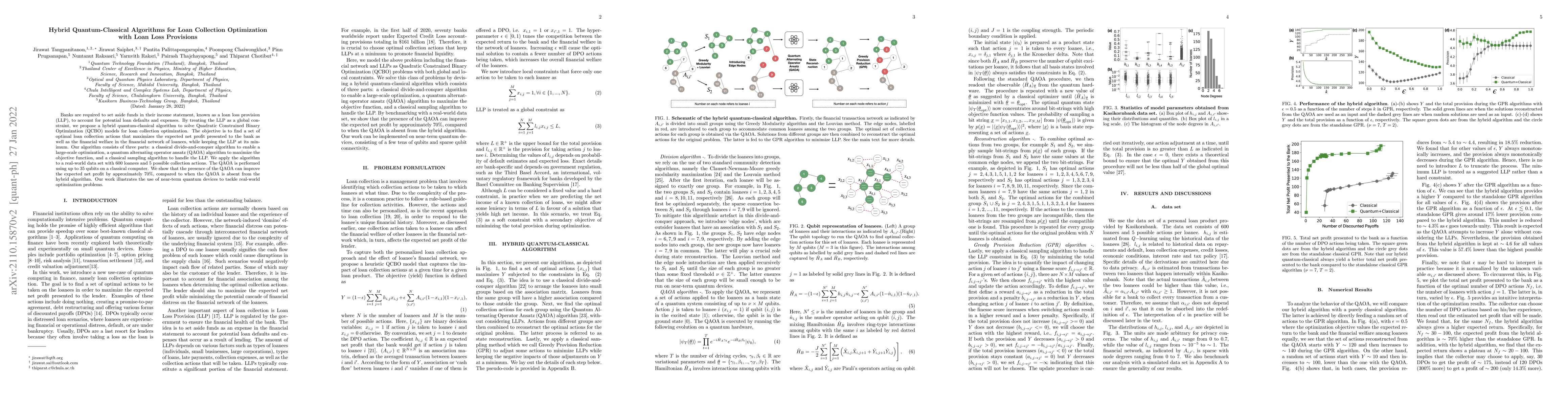

Banks are required to set aside funds in their income statement, known as a loan loss provision (LLP), to account for potential loan defaults and expenses. By treating the LLP as a global constraint, we propose a hybrid quantum-classical algorithm to solve Quadratic Constrained Binary Optimization (QCBO) models for loan collection optimization. The objective is to find a set of optimal loan collection actions that maximizes the expected net profit presented to the bank as well as the financial welfare in the financial network of loanees, while keeping the LLP at its minimum. Our algorithm consists of three parts: a classical divide-and-conquer algorithm to enable a large-scale optimization, a quantum alternating operator ansatz (QAOA) algorithm to maximize the objective function, and a classical sampling algorithm to handle the LLP. We apply the algorithm to a real-world data set with 600 loanees and 5 possible collection actions. The QAOA is performed using up to 35 qubits on a classical computer. We show that the presence of the QAOA can improve the expected net profit by approximately $70\%$, compared to when the QAOA is absent from the hybrid algorithm. Our work illustrates the use of near-term quantum devices to tackle real-world optimization problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)