Authors

Summary

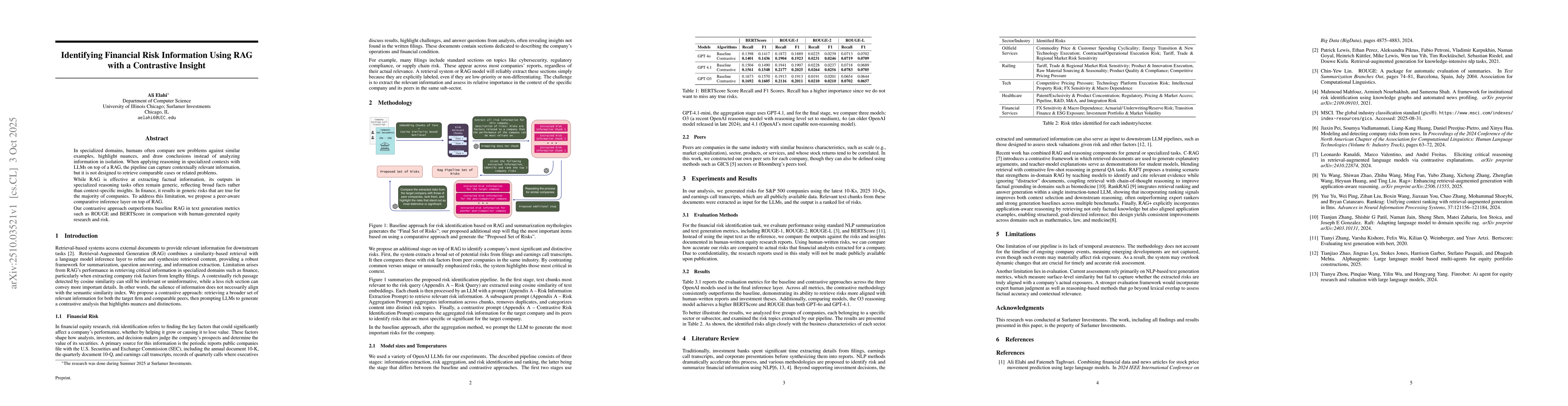

In specialized domains, humans often compare new problems against similar examples, highlight nuances, and draw conclusions instead of analyzing information in isolation. When applying reasoning in specialized contexts with LLMs on top of a RAG, the pipeline can capture contextually relevant information, but it is not designed to retrieve comparable cases or related problems. While RAG is effective at extracting factual information, its outputs in specialized reasoning tasks often remain generic, reflecting broad facts rather than context-specific insights. In finance, it results in generic risks that are true for the majority of companies. To address this limitation, we propose a peer-aware comparative inference layer on top of RAG. Our contrastive approach outperforms baseline RAG in text generation metrics such as ROUGE and BERTScore in comparison with human-generated equity research and risk.

AI Key Findings

Generated Oct 12, 2025

Methodology

The research proposes a peer-aware comparative inference layer on top of RAG to identify financial risks. It uses a three-stage pipeline: information extraction, risk aggregation, and contrastive risk identification. The system compares a company's risks with its peers to highlight unique or significant risks.

Key Results

- The contrastive approach outperforms baseline RAG in ROUGE and BERTScore metrics compared to human-generated equity research.

- The identified risks align closely with the business characteristics of each sector, as shown in the risk titles for different industries.

- The contrastive method improves the accuracy of risk identification by focusing on company-specific and non-generic insights.

Significance

This research addresses the limitation of generic risk identification in financial domains by introducing a contrastive approach that captures context-specific insights, enhancing the accuracy of risk assessment for investment decisions.

Technical Contribution

The technical contribution is the integration of a contrastive inference layer with RAG, enabling the system to identify and prioritize company-specific risks by comparing them against peer companies in the same industry.

Novelty

The novelty lies in the contrastive approach that combines retrieval with comparative reasoning, allowing the system to highlight unique risks for a target company while filtering out generic or universally applicable risks.

Limitations

- The pipeline lacks temporal awareness, potentially missing emerging developments that could affect risk exposure.

- Evaluation relies primarily on NLP-based text generation metrics, which may not fully capture the alignment of extracted risks with actual company exposures.

Future Work

- Incorporate temporal awareness to capture dynamic changes in risk exposure over time.

- Develop stronger evaluation frameworks that include expert human judgment and reasoning-based methods beyond lexical overlap.

Paper Details

PDF Preview

Similar Papers

Found 5 papersInsight-RAG: Enhancing LLMs with Insight-Driven Augmentation

Pouya Pezeshkpour, Estevam Hruschka

Generative AI Enhanced Financial Risk Management Information Retrieval

Amin Haeri, Jonathan Vitrano, Mahdi Ghelichi

Financial Analysis: Intelligent Financial Data Analysis System Based on LLM-RAG

Wen Ding, Xiaotong Zhu, Jingru Wang

Improving RAG for Personalization with Author Features and Contrastive Examples

Suzan Verberne, Mert Yazan, Frederik Situmeang

Comments (0)