Authors

Summary

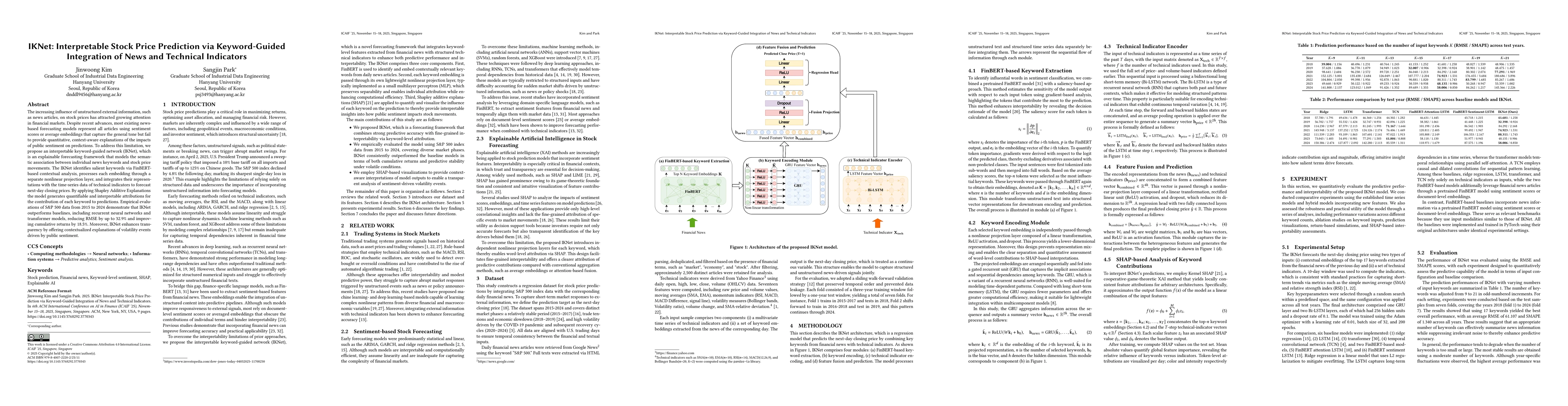

The increasing influence of unstructured external information, such as news articles, on stock prices has attracted growing attention in financial markets. Despite recent advances, most existing newsbased forecasting models represent all articles using sentiment scores or average embeddings that capture the general tone but fail to provide quantitative, context-aware explanations of the impacts of public sentiment on predictions. To address this limitation, we propose an interpretable keyword-guided network (IKNet), which is an explainable forecasting framework that models the semantic association between individual news keywords and stock price movements. The IKNet identifies salient keywords via FinBERTbased contextual analysis, processes each embedding through a separate nonlinear projection layer, and integrates their representations with the time-series data of technical indicators to forecast next-day closing prices. By applying Shapley Additive Explanations the model generates quantifiable and interpretable attributions for the contribution of each keyword to predictions. Empirical evaluations of S&P 500 data from 2015 to 2024 demonstrate that IKNet outperforms baselines, including recurrent neural networks and transformer models, reducing RMSE by up to 32.9% and improving cumulative returns by 18.5%. Moreover, IKNet enhances transparency by offering contextualized explanations of volatility events driven by public sentiment.

AI Key Findings

Generated Oct 11, 2025

Methodology

The research proposes IKNet, a stock prediction model that integrates technical indicators with keywords selectively extracted from financial news using a keyword-level input structure and SHAP-based explanation framework. It employs FinBERT for sentiment analysis and combines it with LSTM for time-series forecasting, validated through comparative experiments and SHAP-based explainability analysis.

Key Results

- IKNet consistently outperforms traditional time-series and news-based models, maintaining robust trend-following behavior and stable returns even under high market volatility.

- A moderate number of input keywords minimizes RMSE and SMAPE, while overly large or small inputs degrade performance, highlighting the need to balance information richness and model complexity.

- SHAP-based analysis identifies the most influential features behind predictions, revealing directional and magnitude contributions at the keyword level with fine-grained attribution.

Significance

This research provides a practical and interpretable stock prediction framework that combines technical analysis with news sentiment, offering both accurate forecasts and insights into market dynamics. It has potential applications in financial decision-making and trading strategies.

Technical Contribution

IKNet introduces a novel integration of technical indicators with sentiment-aware keywords through a keyword-level input structure and SHAP-based explanation framework, addressing limitations of conventional approaches relying on average embeddings or sentiment scores.

Novelty

The work's novelty lies in its fine-grained keyword-level SHAP visualization that enables contextual understanding of sentiment dynamics and external narratives, differing from prior studies focused on global feature importance.

Limitations

- The current model relies on fixed keyword embeddings that may not fully capture contextual shifts in meaning.

- The study focuses on U.S. stock markets, limiting generalizability to other markets.

Future Work

- Incorporate sentence- or context-level representations to improve interpretive precision and generalizability.

- Explore dynamically adjusting the relative importance of news and technical indicators to enhance adaptability to shifting market environments.

Paper Details

PDF Preview

Similar Papers

Found 4 papersFeature selection and regression methods for stock price prediction using technical indicators

Fatemeh Moodi, Amir Jahangard-Rafsanjani, Sajad Zarifzadeh

Assessing the Impact of Technical Indicators on Machine Learning Models for Stock Price Prediction

Chris Monico, Frank J. Fabozzi, Abootaleb Shirvani et al.

Predicting The Stock Trend Using News Sentiment Analysis and Technical Indicators in Spark

Taylan Kabbani, Fatih Enes Usta

S&P 500 Stock Price Prediction Using Technical, Fundamental and Text Data

Shan Zhong, David B. Hitchcock

Comments (0)