Authors

Summary

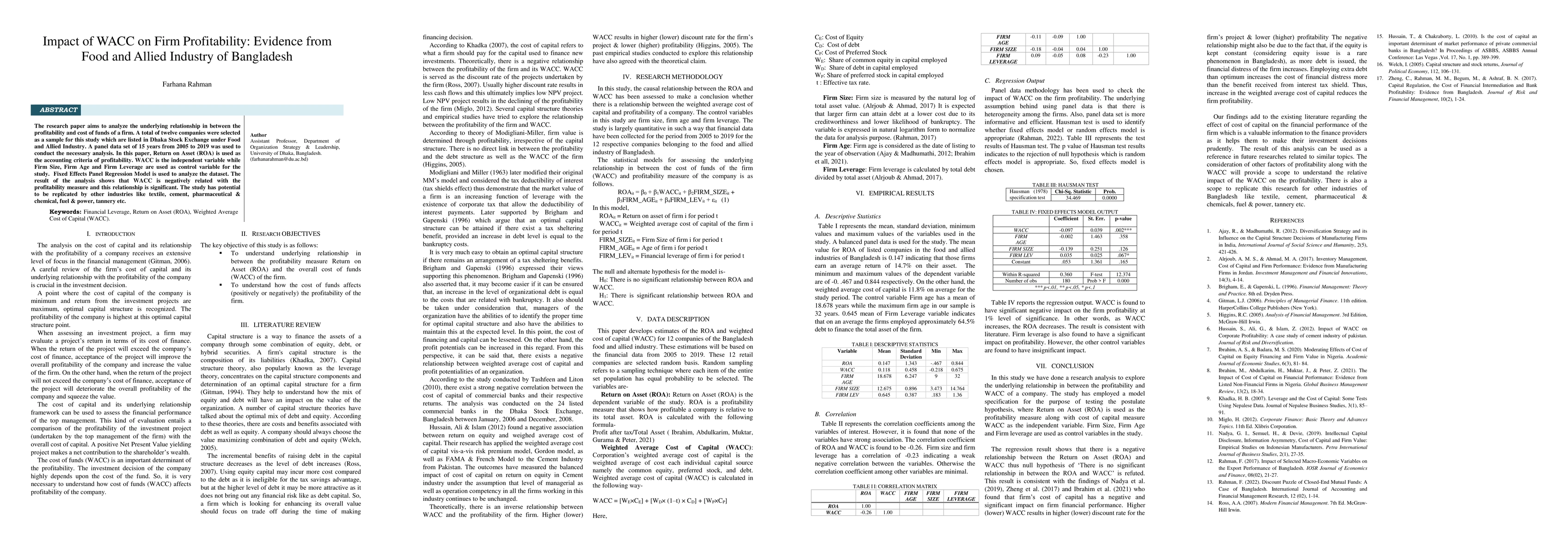

The research paper aims to analyze the underlying relationship in between the profitability and cost of funds of a firm. A total of twelve companies were selected as a sample for this study which are listed in Dhaka Stock Exchange under Food and Allied Industry. A panel data set of 15 years from 2005 to 2019 was used to conduct the necessary analysis. In this paper, Return on Asset (ROA) is used as the accounting criteria of profitability. WACC is the independent variable while Firm Size, Firm Age and Firm Leverage are used as control variable for the study. Fixed Effects Panel Regression Model is used to analyze the dataset. The result of the analysis shows that WACC is negatively related with the profitability measure and this relationship is significant. The study has potential to be replicated by other industries like textile, cement, pharmaceutical & chemical, fuel & power, tannery etc.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)