Authors

Summary

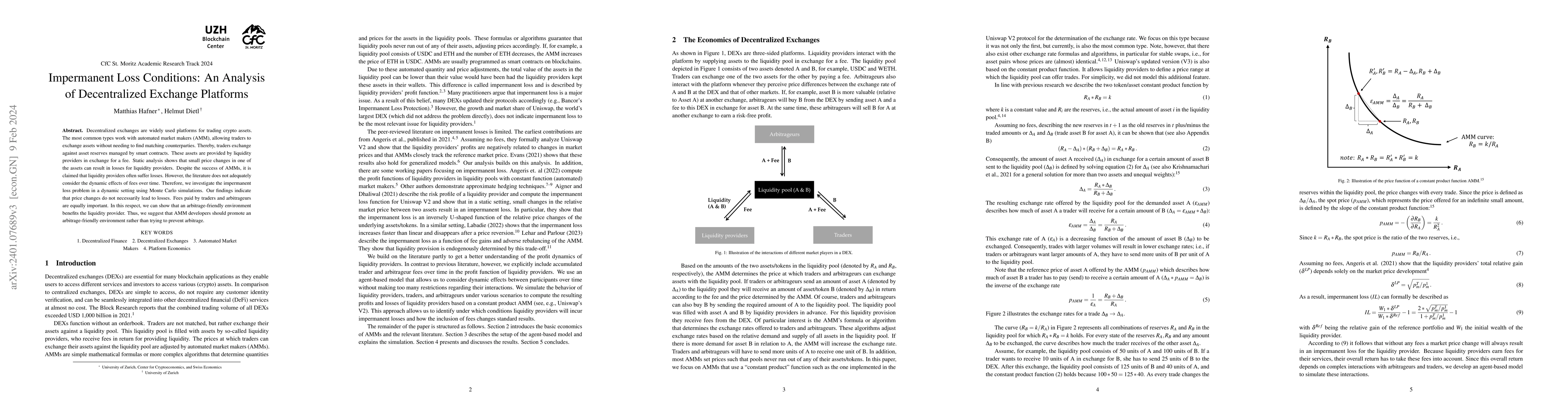

Decentralized exchanges are widely used platforms for trading crypto assets. The most common types work with automated market makers (AMM), allowing traders to exchange assets without needing to find matching counterparties. Thereby, traders exchange against asset reserves managed by smart contracts. These assets are provided by liquidity providers in exchange for a fee. Static analysis shows that small price changes in one of the assets can result in losses for liquidity providers. Despite the success of AMMs, it is claimed that liquidity providers often suffer losses. However, the literature does not adequately consider the dynamic effects of fees over time. Therefore, we investigate the impermanent loss problem in a dynamic setting using Monte Carlo simulations. Our findings indicate that price changes do not necessarily lead to losses. Fees paid by traders and arbitrageurs are equally important. In this respect, we can show that an arbitrage-friendly environment benefits the liquidity provider. Thus, we suggest that AMM developers should promote an arbitrage-friendly environment rather than trying to prevent arbitrage.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGeneralizing Impermanent Loss on Decentralized Exchanges with Constant Function Market Makers

Danilo Mandic, Peter Yatsyshin, Rohan Tangri et al.

Dynamic Fee for Reducing Impermanent Loss in Decentralized Exchanges

Yury Yanovich, Ignat Melnikov, Irina Lebedeva et al.

Improving Capital Efficiency and Impermanent Loss: Multi-Token Proactive Market Maker

Preston Rozwood, Wayne Chen, Songwei Chen

| Title | Authors | Year | Actions |

|---|

Comments (0)