Summary

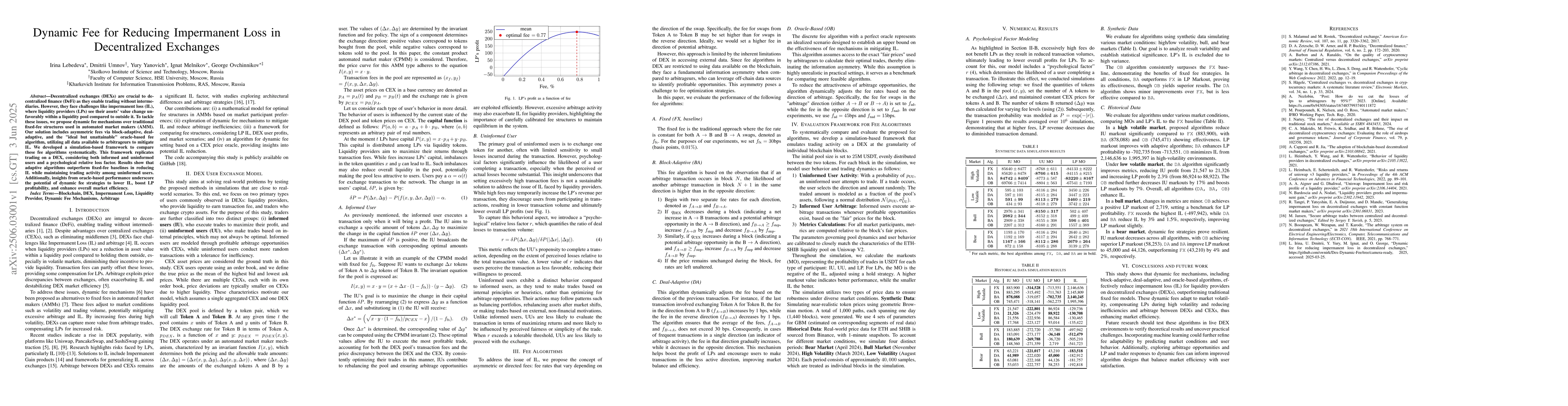

Decentralized exchanges (DEXs) are crucial to decentralized finance (DeFi) as they enable trading without intermediaries. However, they face challenges like impermanent loss (IL), where liquidity providers (LPs) see their assets' value change unfavorably within a liquidity pool compared to outside it. To tackle these issues, we propose dynamic fee mechanisms over traditional fixed-fee structures used in automated market makers (AMM). Our solution includes asymmetric fees via block-adaptive, deal-adaptive, and the "ideal but unattainable" oracle-based fee algorithm, utilizing all data available to arbitrageurs to mitigate IL. We developed a simulation-based framework to compare these fee algorithms systematically. This framework replicates trading on a DEX, considering both informed and uninformed users and a psychological relative loss factor. Results show that adaptive algorithms outperform fixed-fee baselines in reducing IL while maintaining trading activity among uninformed users. Additionally, insights from oracle-based performance underscore the potential of dynamic fee strategies to lower IL, boost LP profitability, and enhance overall market efficiency.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGeneralizing Impermanent Loss on Decentralized Exchanges with Constant Function Market Makers

Danilo Mandic, Peter Yatsyshin, Rohan Tangri et al.

Impermanent Loss Conditions: An Analysis of Decentralized Exchange Platforms

Matthias Hafner, Helmut Dietl

Better market Maker Algorithm to Save Impermanent Loss with High Liquidity Retention

CY Yan, Steve Keol, Xo Co et al.

No citations found for this paper.

Comments (0)