Summary

We consider the computation of model-free bounds for multi-asset options in a setting that combines dependence uncertainty with additional information on the dependence structure. More specifically, we consider the setting where the marginal distributions are known and partial information, in the form of known prices for multi-asset options, is also available in the market. We provide a fundamental theorem of asset pricing in this setting, as well as a superhedging duality that allows to transform the maximization problem over probability measures in a more tractable minimization problem over trading strategies. The latter is solved using a penalization approach combined with a deep learning approximation using artificial neural networks. The numerical method is fast and the computational time scales linearly with respect to the number of traded assets. We finally examine the significance of various pieces of additional information. Empirical evidence suggests that "relevant" information, i.e. prices of derivatives with the same payoff structure as the target payoff, are more useful that other information, and should be prioritized in view of the trade-off between accuracy and computational efficiency.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

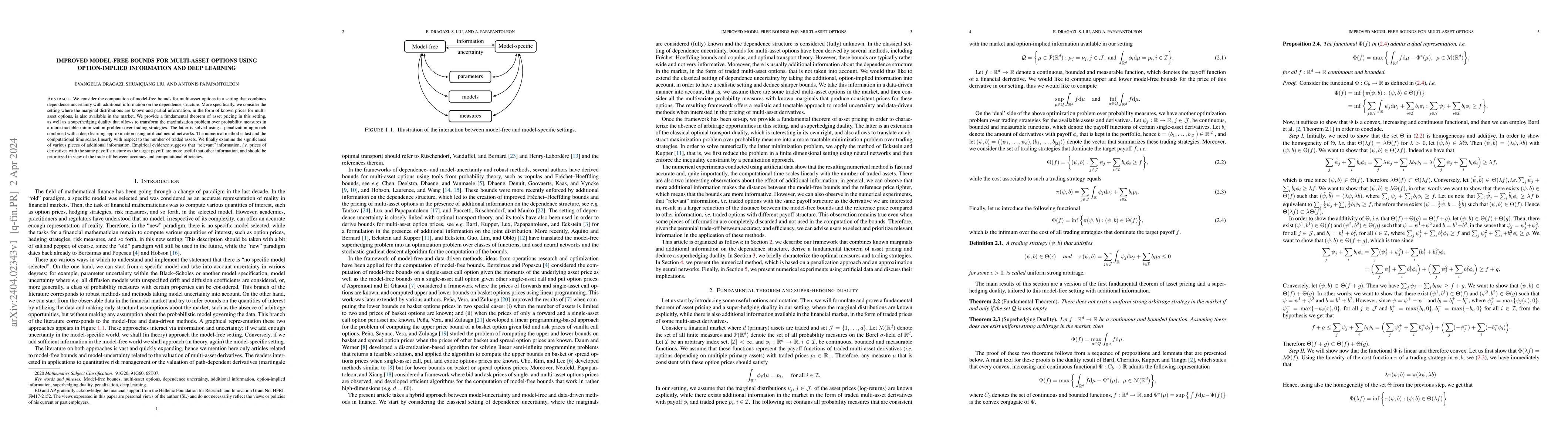

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModel-free bounds for multi-asset options using option-implied information and their exact computation

Ariel Neufeld, Antonis Papapantoleon, Qikun Xiang

Improved Robust Price Bounds for Multi-Asset Derivatives under Market-Implied Dependence Information

Julian Sester, Ariel Neufeld, Jonathan Ansari et al.

No citations found for this paper.

Comments (0)