Authors

Summary

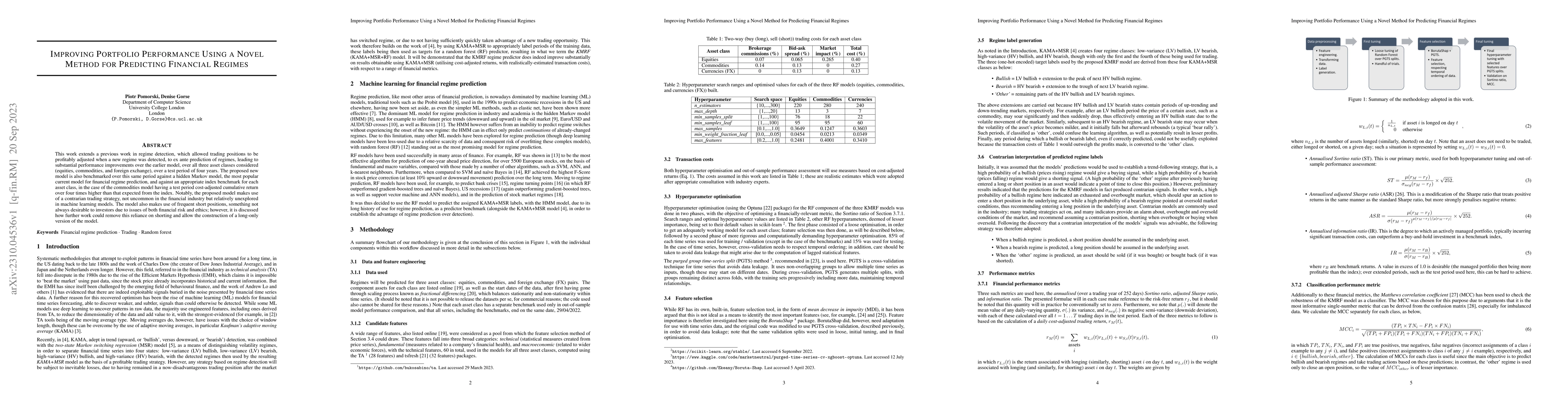

This work extends a previous work in regime detection, which allowed trading positions to be profitably adjusted when a new regime was detected, to ex ante prediction of regimes, leading to substantial performance improvements over the earlier model, over all three asset classes considered (equities, commodities, and foreign exchange), over a test period of four years. The proposed new model is also benchmarked over this same period against a hidden Markov model, the most popular current model for financial regime prediction, and against an appropriate index benchmark for each asset class, in the case of the commodities model having a test period cost-adjusted cumulative return over four times higher than that expected from the index. Notably, the proposed model makes use of a contrarian trading strategy, not uncommon in the financial industry but relatively unexplored in machine learning models. The model also makes use of frequent short positions, something not always desirable to investors due to issues of both financial risk and ethics; however, it is discussed how further work could remove this reliance on shorting and allow the construction of a long-only version of the model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Simple Method for Predicting Covariance Matrices of Financial Returns

Stephen Boyd, Markus Pelger, Kasper Johansson et al.

Next Generation Models for Portfolio Risk Management: An Approach Using Financial Big Data

Donggyu Kim, Kwangmin Jung, Seunghyeon Yu

| Title | Authors | Year | Actions |

|---|

Comments (0)