Summary

We study a Markov-Functional (MF) interest-rate model with Uncertain Volatility Displaced Diffusion (UVDD) digital mapping, which is consistent with the volatility-smile phenomenon observed in the option market. We first check the impact of pricing Bermudan swaptions by the model. Next, we also investigate the future smiles implied by the MF models and the smile dynamics implied by the UVDD model. Finally, we conduct hedging simulations against Bermudan swaptions to test extensively the hedge performance of this smile-consistenet MF model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

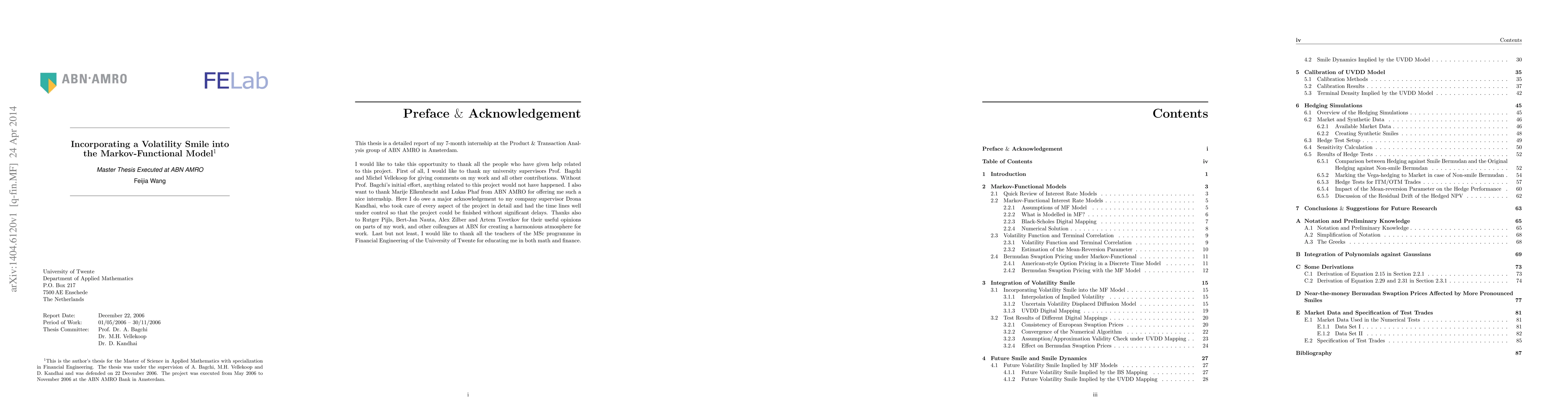

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSmile asymptotic for Bachelier Implied Volatility

Roberto Baviera, Michele Domenico Massaria

No citations found for this paper.

Comments (0)