Authors

Summary

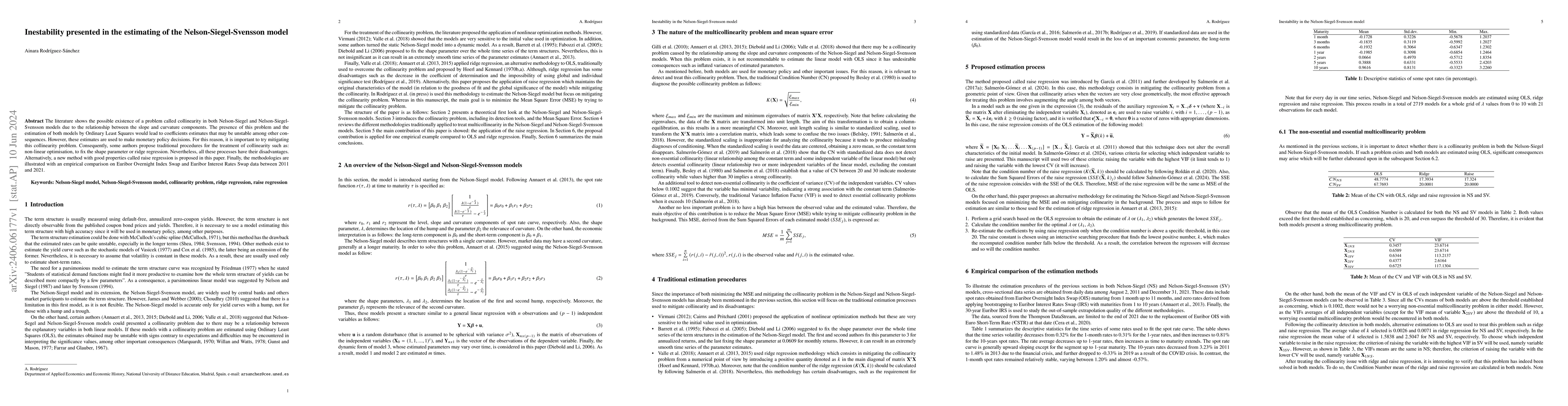

The literature shows the possible existence of a problem called collinearity in both Nelson-Siegel and Nelson-Siegel-Svensson models due to the relationship between the slope and curvature components. The presence of this problem and the estimation of both models by Ordinary Least Squares would lead to coefficients estimates that may be unstable among other consequences. However, these estimates are used to make monetary policy decisions. For this reason, it is important to try mitigating this collinearity problem. Consequently, some authors propose traditional procedures for the treatment of collinearity such as: non-linear optimisation, to fix the shape parameter or ridge regression. Nevertheless, all these processes have their disadvantages. Alternatively, a new method with good properties called raise regression is proposed in this paper. Finally, the methodologies are illustrated with an empirical comparison on Euribor Overnight Index Swap and Euribor Interest Rates Swap data between 2011 and 2021.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTerm structure shapes and their consistent dynamics in the Svensson family

Martin Keller-Ressel, Felix Sachse

No citations found for this paper.

Comments (0)