Summary

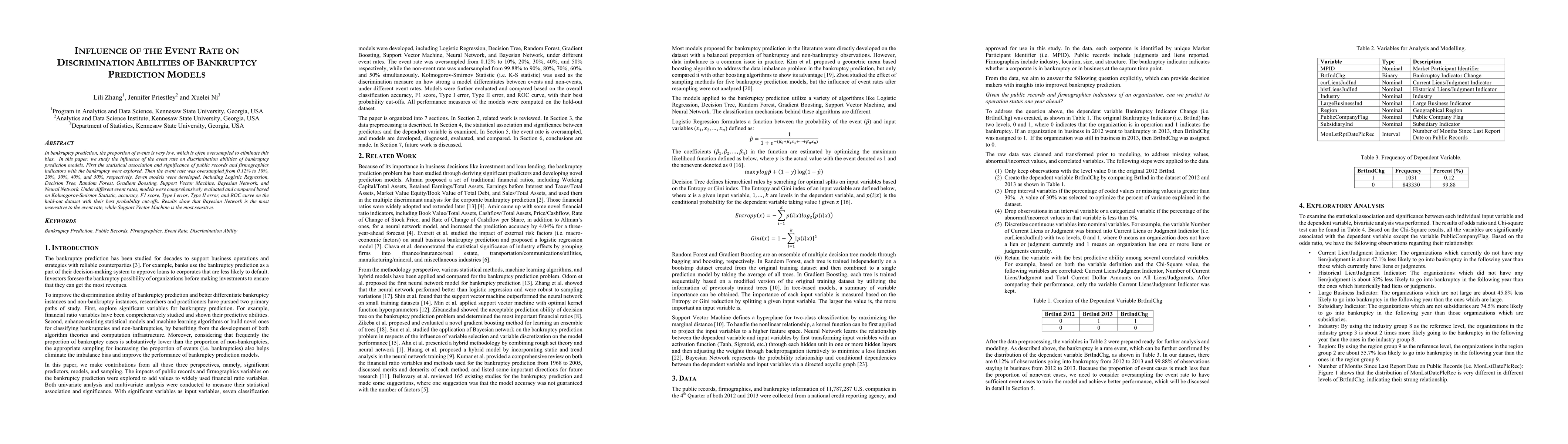

In bankruptcy prediction, the proportion of events is very low, which is often oversampled to eliminate this bias. In this paper, we study the influence of the event rate on discrimination abilities of bankruptcy prediction models. First the statistical association and significance of public records and firmographics indicators with the bankruptcy were explored. Then the event rate was oversampled from 0.12% to 10%, 20%, 30%, 40%, and 50%, respectively. Seven models were developed, including Logistic Regression, Decision Tree, Random Forest, Gradient Boosting, Support Vector Machine, Bayesian Network, and Neural Network. Under different event rates, models were comprehensively evaluated and compared based on Kolmogorov-Smirnov Statistic, accuracy, F1 score, Type I error, Type II error, and ROC curve on the hold-out dataset with their best probability cut-offs. Results show that Bayesian Network is the most insensitive to the event rate, while Support Vector Machine is the most sensitive.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultimodal Generative Models for Bankruptcy Prediction Using Textual Data

Kjersti Aas, Rogelio A. Mancisidor

From Numbers to Words: Multi-Modal Bankruptcy Prediction Using the ECL Dataset

Thomas Demeester, Henri Arno, Klaas Mulier et al.

Augmenting Bankruptcy Prediction using Reported Behavior of Corporate Restructuring

Xinlin Wang, Mats Brorsson

| Title | Authors | Year | Actions |

|---|

Comments (0)