Summary

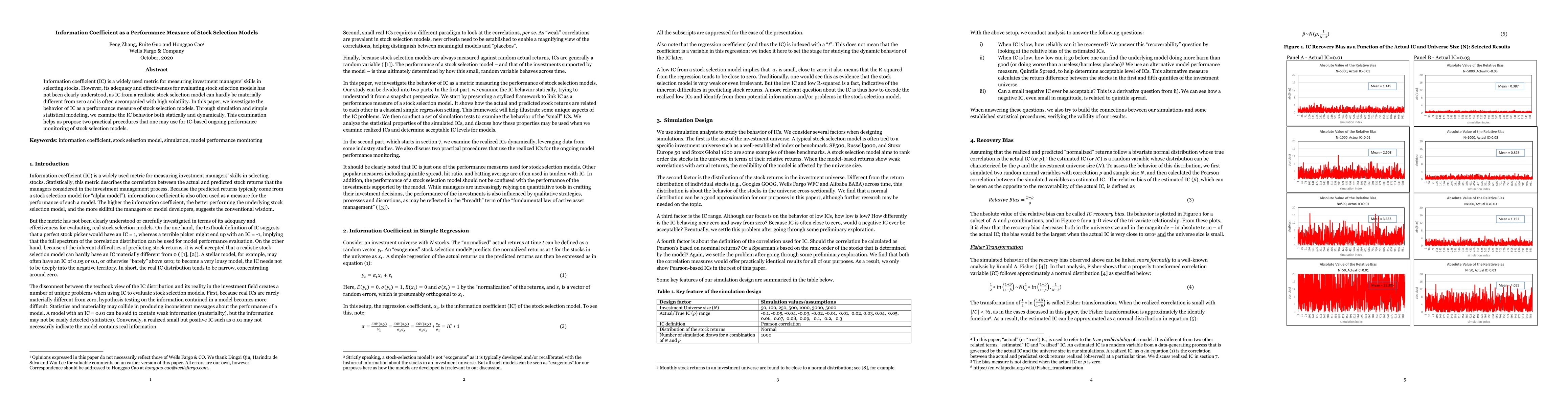

Information coefficient (IC) is a widely used metric for measuring investment managers' skills in selecting stocks. However, its adequacy and effectiveness for evaluating stock selection models has not been clearly understood, as IC from a realistic stock selection model can hardly be materially different from zero and is often accompanies with high volatility. In this paper, we investigate the behavior of IC as a performance measure of stick selection models. Through simulation and simple statistical modeling, we examine the IC behavior both statically and dynamically. The examination helps us propose two practical procedures that one may use for IC-based ongoing performance monitoring of stock selection models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIntegrating Stock Features and Global Information via Large Language Models for Enhanced Stock Return Prediction

Tianyi Ma, Dongming Han, Yujie Ding et al.

Radiomics as a measure superior to the Dice similarity coefficient for tumor segmentation performance evaluation

Yoichi Watanabe, Rukhsora Akramova

Productivity of Short Term Assets as a Signal of Future Stock Performance

Veer Vohra, Devyani Vij, Jehil Mehta et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)