Summary

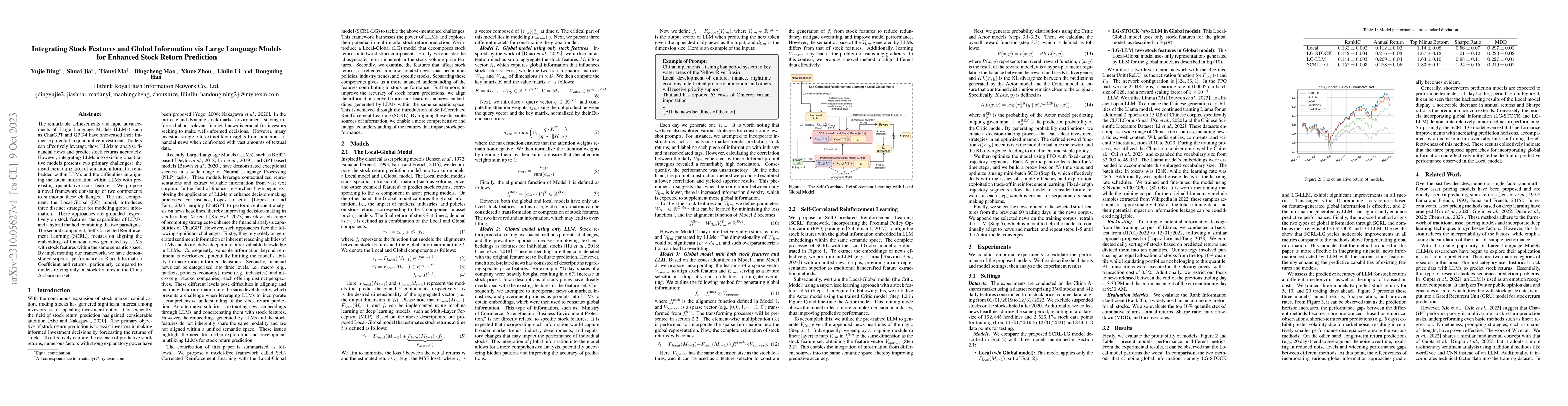

The remarkable achievements and rapid advancements of Large Language Models (LLMs) such as ChatGPT and GPT-4 have showcased their immense potential in quantitative investment. Traders can effectively leverage these LLMs to analyze financial news and predict stock returns accurately. However, integrating LLMs into existing quantitative models presents two primary challenges: the insufficient utilization of semantic information embedded within LLMs and the difficulties in aligning the latent information within LLMs with pre-existing quantitative stock features. We propose a novel framework consisting of two components to surmount these challenges. The first component, the Local-Global (LG) model, introduces three distinct strategies for modeling global information. These approaches are grounded respectively on stock features, the capabilities of LLMs, and a hybrid method combining the two paradigms. The second component, Self-Correlated Reinforcement Learning (SCRL), focuses on aligning the embeddings of financial news generated by LLMs with stock features within the same semantic space. By implementing our framework, we have demonstrated superior performance in Rank Information Coefficient and returns, particularly compared to models relying only on stock features in the China A-share market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFine-Tuning Large Language Models for Stock Return Prediction Using Newsflow

Tian Guo, Emmanuel Hauptmann

Can ChatGPT Forecast Stock Price Movements? Return Predictability and Large Language Models

Alejandro Lopez-Lira, Yuehua Tang

StockTime: A Time Series Specialized Large Language Model Architecture for Stock Price Prediction

Shengkun Wang, Taoran Ji, Linhan Wang et al.

Enhancing Few-Shot Stock Trend Prediction with Large Language Models

Jiahao Hu, Yiqi Deng, Xingwei He et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)