Authors

Summary

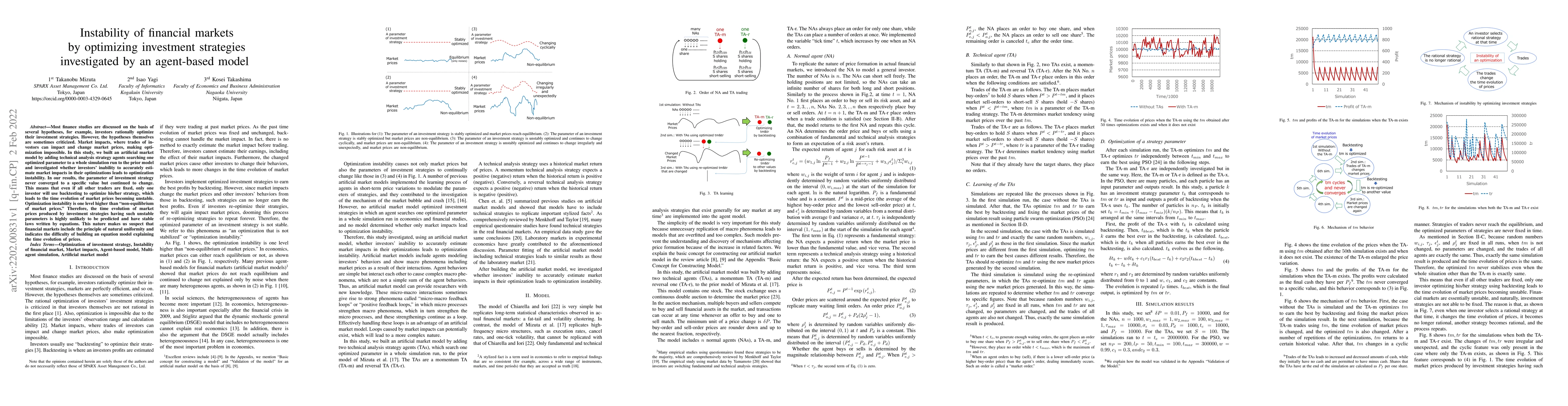

Most finance studies are discussed on the basis of several hypotheses, for example, investors rationally optimize their investment strategies. However, the hypotheses themselves are sometimes criticized. Market impacts, where trades of investors can impact and change market prices, making optimization impossible. In this study, we built an artificial market model by adding technical analysis strategy agents searching one optimized parameter to a whole simulation run to the prior model and investigated whether investors' inability to accurately estimate market impacts in their optimizations leads to optimization instability. In our results, the parameter of investment strategy never converged to a specific value but continued to change. This means that even if all other traders are fixed, only one investor will use backtesting to optimize his/her strategy, which leads to the time evolution of market prices becoming unstable. Optimization instability is one level higher than "non-equilibrium of market prices." Therefore, the time evolution of market prices produced by investment strategies having such unstable parameters is highly unlikely to be predicted and have stable laws written by equations. This nature makes us suspect that financial markets include the principle of natural uniformity and indicates the difficulty of building an equation model explaining the time evolution of prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhancing Investment Analysis: Optimizing AI-Agent Collaboration in Financial Research

Neng Wang, Kunpeng Zhang, Sean Xin Xu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)