Authors

Summary

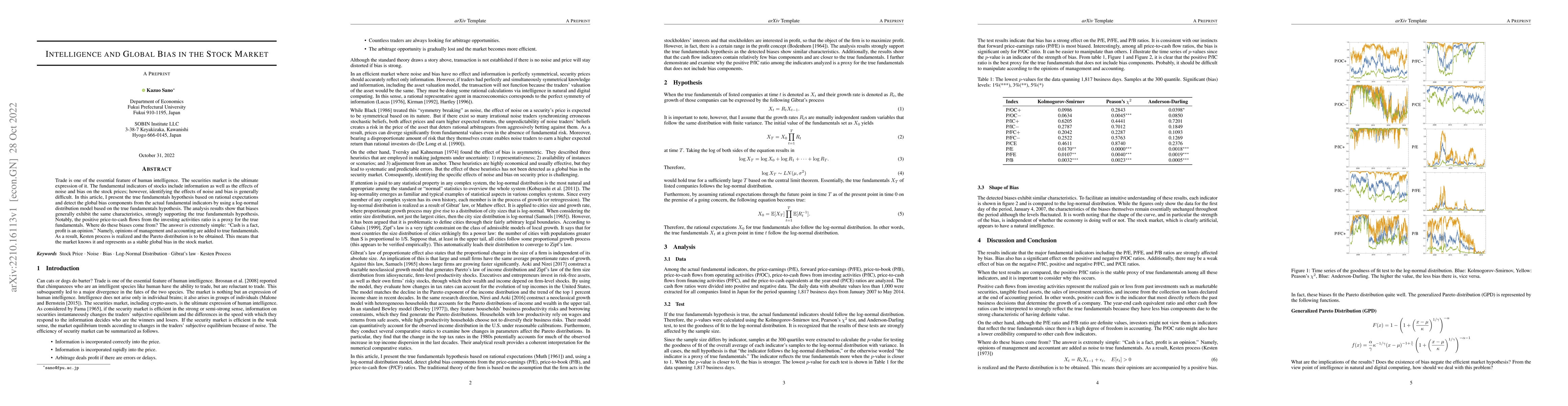

Trade is one of the essential feature of human intelligence. The securities market is the ultimate expression of it. The fundamental indicators of stocks include information as well as the effects of noise and bias on the stock prices; however, identifying the effects of noise and bias is generally difficult. In this article, I present the true fundamentals hypothesis based on rational expectations and detect the global bias components from the actual fundamental indicators by using a log-normal distribution model based on the true fundamentals hypothesis. The analysis results show that biases generally exhibit the same characteristics, strongly supporting the true fundamentals hypothesis. Notably, the positive price-to-cash flows from the investing activities ratio is a proxy for the true fundamentals. Where do these biases come from? The answer is extremely simple: ``Cash is a fact, profit is an opinion.'' Namely, opinions of management and accounting are added to true fundamentals. As a result, Kesten process is realized and the Pareto distribution is to be obtained. This means that the market knows it and represents as a stable global bias in the stock market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIndian Stock Market Prediction using Augmented Financial Intelligence ML

Anishka Chauhan, Pratham Mayur, Yeshwanth Sai Gokarakonda et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)