Authors

Summary

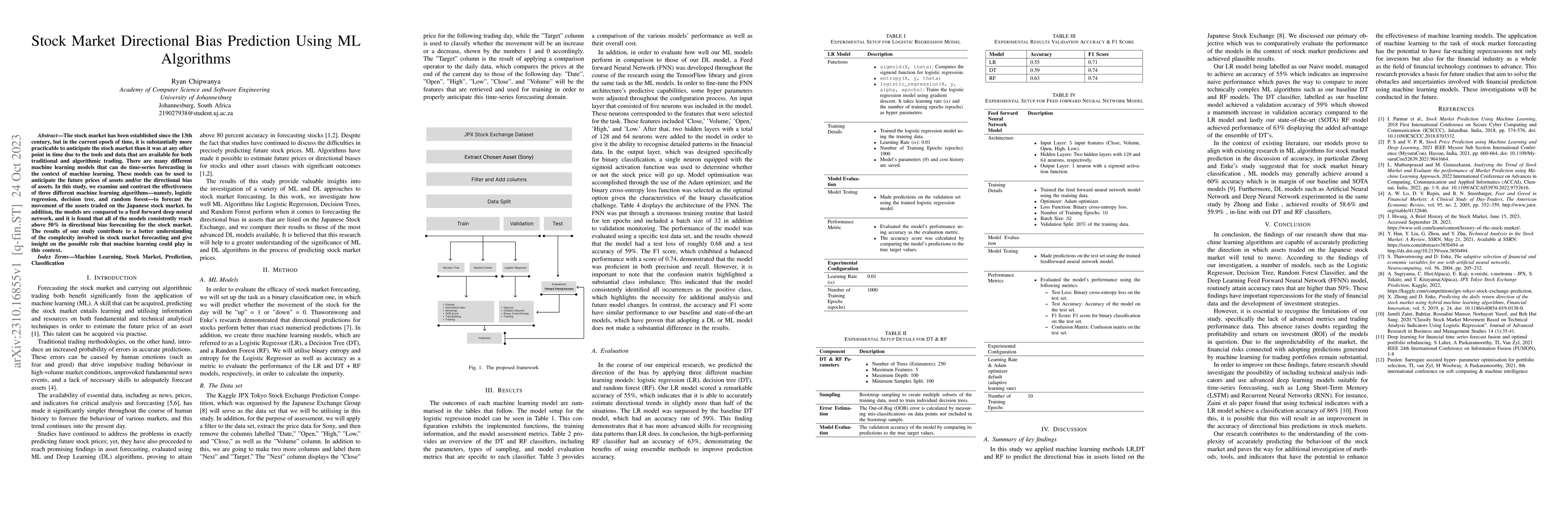

The stock market has been established since the 13th century, but in the current epoch of time, it is substantially more practicable to anticipate the stock market than it was at any other point in time due to the tools and data that are available for both traditional and algorithmic trading. There are many different machine learning models that can do time-series forecasting in the context of machine learning. These models can be used to anticipate the future prices of assets and/or the directional bias of assets. In this study, we examine and contrast the effectiveness of three different machine learning algorithms, namely, logistic regression, decision tree, and random forest to forecast the movement of the assets traded on the Japanese stock market. In addition, the models are compared to a feed forward deep neural network, and it is found that all of the models consistently reach above 50% in directional bias forecasting for the stock market. The results of our study contribute to a better understanding of the complexity involved in stock market forecasting and give insight on the possible role that machine learning could play in this context.

AI Key Findings

Generated Sep 02, 2025

Methodology

The study applies machine learning methods (Logistic Regression, Decision Tree, Random Forest) to predict the directional bias in assets listed on the Japanese Stock Exchange, comparing their performance with a Deep Learning model (Feed Forward Neural Network).

Key Results

- Logistic Regression achieved an accuracy of 55%.

- Decision Tree surpassed Logistic Regression with a validation accuracy of 59%.

- Random Forest, the most advanced model, demonstrated an accuracy of 63%.

- The Deep Learning model (Feed Forward Neural Network) had a test loss of approximately 0.68 and a test accuracy of 59%.

- All models consistently reached above 50% in directional bias forecasting for the stock market.

Significance

This research contributes to a better understanding of the complexity involved in stock market forecasting and provides insight into the possible role of machine learning in this context.

Technical Contribution

The study demonstrates the capability of machine learning algorithms in accurately predicting the direction in which assets traded on the Japanese stock market will move.

Novelty

The research aligns with existing literature on ML algorithms for stock market prediction, showing that models like Logistic Regressor, Decision Tree, and Random Forest can achieve accuracies comparable to deep learning models in stock market directional bias prediction.

Limitations

- The study lacks advanced metrics and trading performance data.

- Financial risks remain substantial due to the unpredictability of the market.

- No consideration of technical analysis indicators or advanced deep learning models like LSTM and RNN.

Future Work

- Investigate the inclusion of technical analysis indicators in predictions.

- Explore the use of advanced deep learning models for time-series forecasting.

- Examine the profitability and return on investment (ROI) of the models.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIndian Stock Market Prediction using Augmented Financial Intelligence ML

Anishka Chauhan, Pratham Mayur, Yeshwanth Sai Gokarakonda et al.

GRUvader: Sentiment-Informed Stock Market Prediction

Bayode Ogunleye, Olamilekan Shobayo, Akhila Mamillapalli et al.

Hidden Markov Models for Stock Market Prediction

Luigi Catello, Ludovica Ruggiero, Lucia Schiavone et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)