Summary

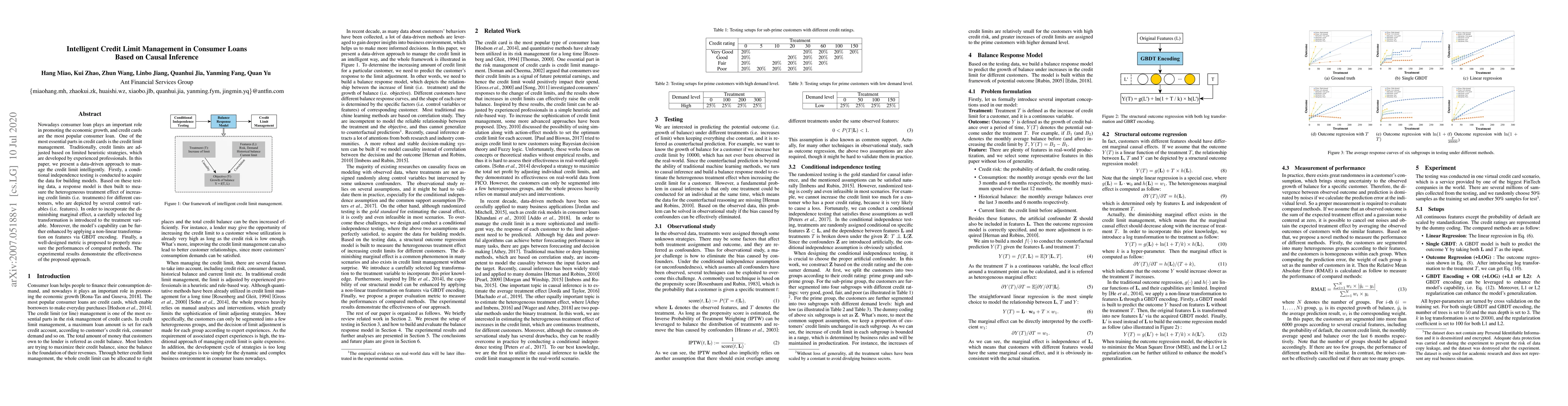

Nowadays consumer loan plays an important role in promoting the economic growth, and credit cards are the most popular consumer loan. One of the most essential parts in credit cards is the credit limit management. Traditionally, credit limits are adjusted based on limited heuristic strategies, which are developed by experienced professionals. In this paper, we present a data-driven approach to manage the credit limit intelligently. Firstly, a conditional independence testing is conducted to acquire the data for building models. Based on these testing data, a response model is then built to measure the heterogeneous treatment effect of increasing credit limits (i.e. treatments) for different customers, who are depicted by several control variables (i.e. features). In order to incorporate the diminishing marginal effect, a carefully selected log transformation is introduced to the treatment variable. Moreover, the model's capability can be further enhanced by applying a non-linear transformation on features via GBDT encoding. Finally, a well-designed metric is proposed to properly measure the performances of compared methods. The experimental results demonstrate the effectiveness of the proposed approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn the Convergence of Credit Risk in Current Consumer Automobile Loans

Jun Yan, Jackson P. Lautier, Vladimir Pozdnyakov

Research on Personal Credit Risk Assessment Methods Based on Causal Inference

Jiaxin Wang, YiLong Ma

What Matters to Individual Investors: Price Setting in Online Auctions of P2P Consumer Loans

Andreas Dietrich, Reto Rey

| Title | Authors | Year | Actions |

|---|

Comments (0)