Summary

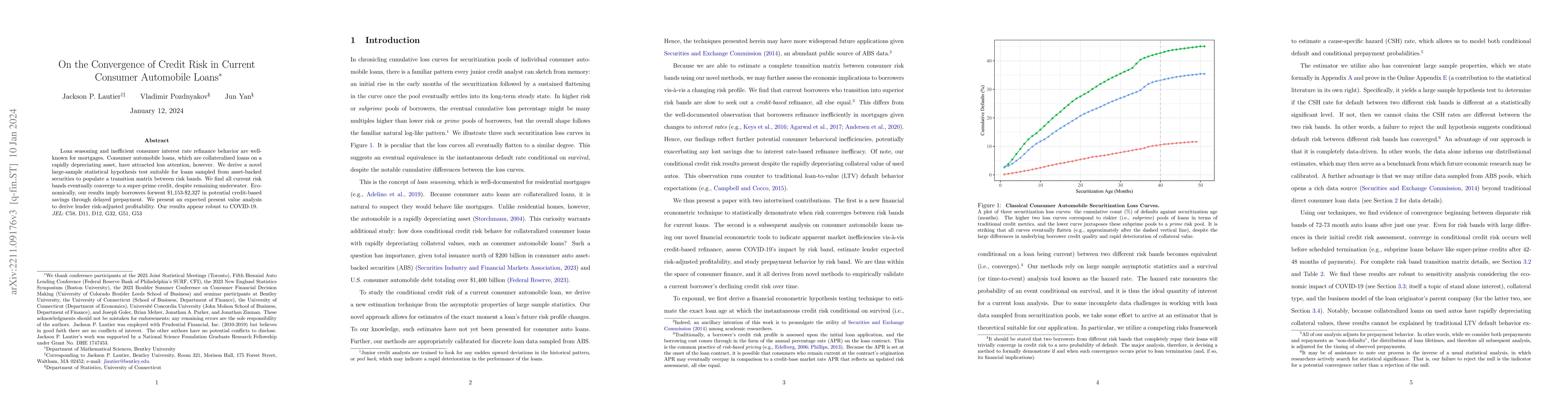

Loan seasoning and inefficient consumer interest rate refinance behavior are well-known for mortgages. Consumer automobile loans, which are collateralized loans on a rapidly depreciating asset, have attracted less attention, however. We derive a novel large-sample statistical hypothesis test suitable for loans sampled from asset-backed securities to populate a transition matrix between risk bands. We find all current risk bands eventually converge to a super-prime credit, despite remaining underwater. Economically, our results imply borrowers forwent \$1,153-\$2,327 in potential credit-based savings through delayed prepayment. We present an expected present value analysis to derive lender risk-adjusted profitability. Our results appear robust to COVID-19.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit risk for large portfolios of green and brown loans: extending the ASRF model

Sergio Scarlatti, Alessandro Ramponi

What Matters to Individual Investors: Price Setting in Online Auctions of P2P Consumer Loans

Andreas Dietrich, Reto Rey

No citations found for this paper.

Comments (0)