Summary

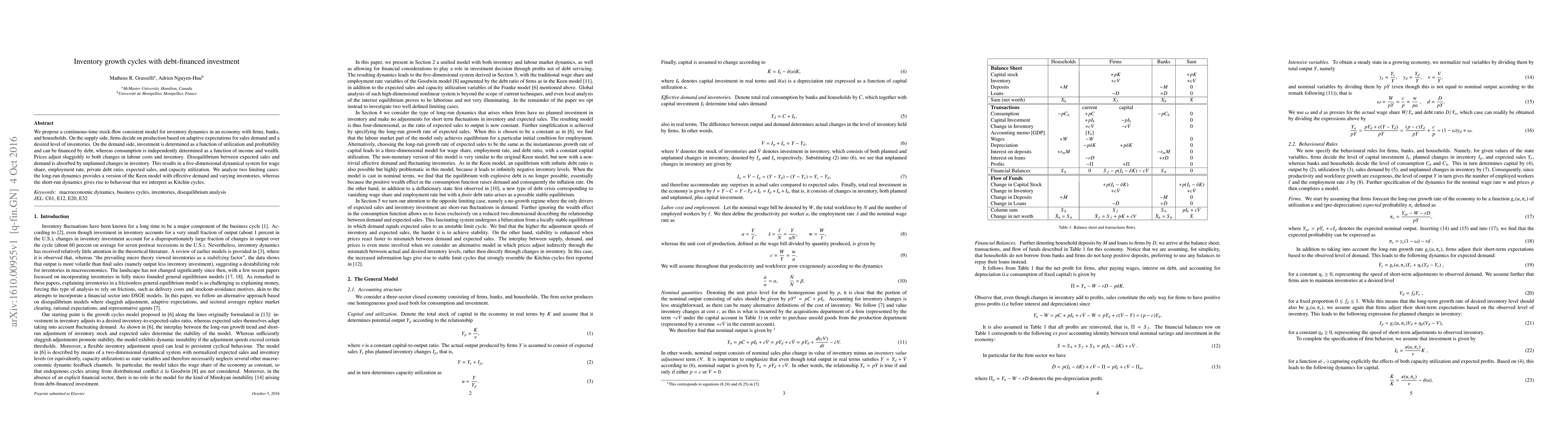

We propose a continuous-time stock-flow consistent model for inventory dynamics in an economy with firms, banks, and households. On the supply side, firms decide on production based on adaptive expectations for sales demand and a desired level of inventories. On the demand side, investment is determined as a function of utilization and profitability and can be financed by debt, whereas consumption is independently determined as a function of income and wealth. Prices adjust sluggishly to both changes in labour costs and inventory. Disequilibrium between expected sales and demand is absorbed by unplanned changes in inventory. This results in a five-dimensional dynamical system for wage share, employment rate, private debt ratio, expected sales, and capacity utilization. We analyze two limiting cases: the long-run dynamics provides a version of the Keen model with effective demand and varying inventories, whereas the short-run dynamics gives rise to behaviour that we interpret as Kitchin cycles.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDebt-Financed Collateral and Stability Risks in the DeFi Ecosystem

Leandros Tassiulas, Georgios Palaiokrassas, Michael Darlin

Characterizing Public Debt Cycles: Don't Ignore the Impact of Financial Cycles

Yingying Xu, Tianbao Zhou, Zhixin Liu

| Title | Authors | Year | Actions |

|---|

Comments (0)