Summary

We study Nash equilibria for inventory-averse high-frequency traders (HFTs), who trade to exploit information about future price changes. For discrete trading rounds, the HFTs' optimal trading strategies and their equilibrium price impact are described by a system of nonlinear equations; explicit solutions obtain around the continuous-time limit. Unlike in the risk-neutral case, the optimal inventories become mean-reverting and vanish as the number of trading rounds becomes large. In contrast, the HFTs' risk-adjusted profits and the equilibrium price impact converge to their risk-neutral counterparts. Compared to a social-planner solution for cooperative HFTs, Nash competition leads to excess trading, so that marginal transaction taxes in fact decrease market liquidity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

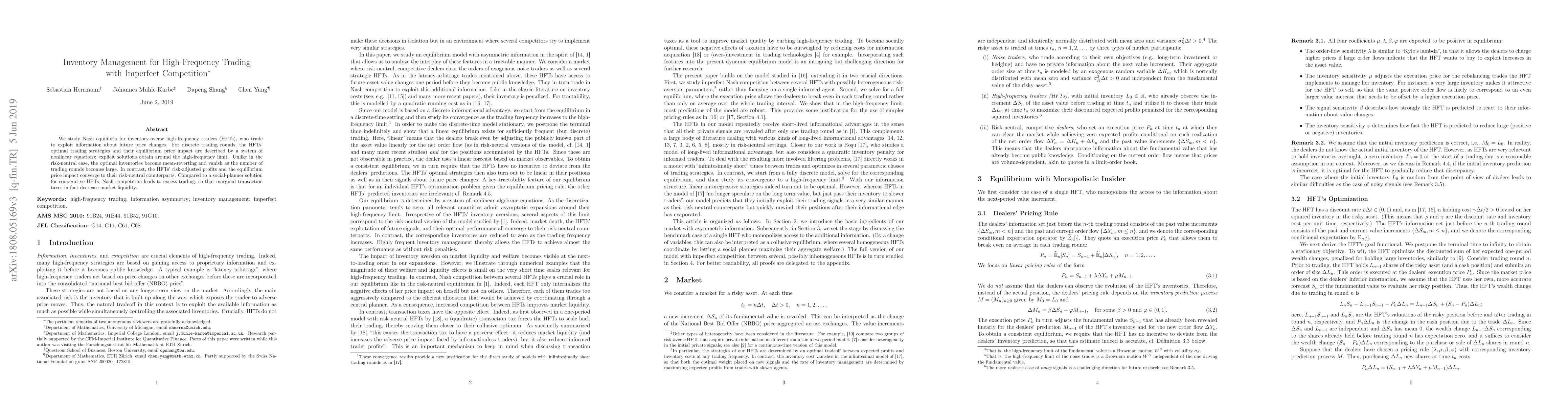

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLabel Unbalance in High-frequency Trading

Zijian Zhao, Xuming Zhang, Xiaoteng Ma et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)