Summary

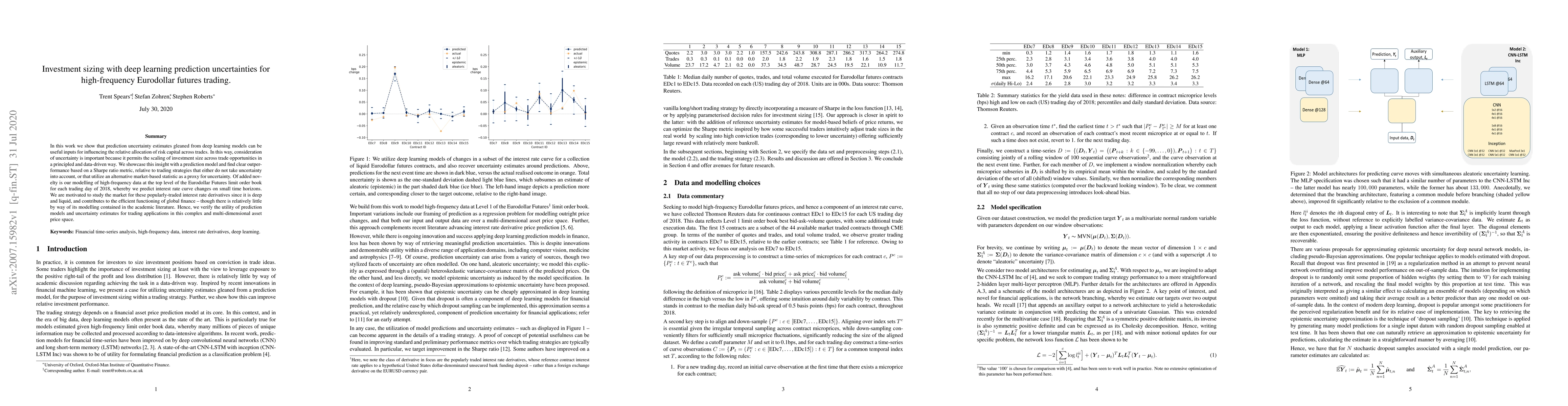

In this work we show that prediction uncertainty estimates gleaned from deep learning models can be useful inputs for influencing the relative allocation of risk capital across trades. In this way, consideration of uncertainty is important because it permits the scaling of investment size across trade opportunities in a principled and data-driven way. We showcase this insight with a prediction model and find clear outperformance based on a Sharpe ratio metric, relative to trading strategies that either do not take uncertainty into account, or that utilize an alternative market-based statistic as a proxy for uncertainty. Of added novelty is our modelling of high-frequency data at the top level of the Eurodollar Futures limit order book for each trading day of 2018, whereby we predict interest rate curve changes on small time horizons. We are motivated to study the market for these popularly-traded interest rate derivatives since it is deep and liquid, and contributes to the efficient functioning of global finance -- though there is relatively little by way of its modelling contained in the academic literature. Hence, we verify the utility of prediction models and uncertainty estimates for trading applications in this complex and multi-dimensional asset price space.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Reinforcement Learning for Active High Frequency Trading

Antonio Briola, Tomaso Aste, Alvaro Cauderan et al.

Futures Quantitative Investment with Heterogeneous Continual Graph Neural Network

Bin Liu, Guosheng Yin, Min Hu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)