Summary

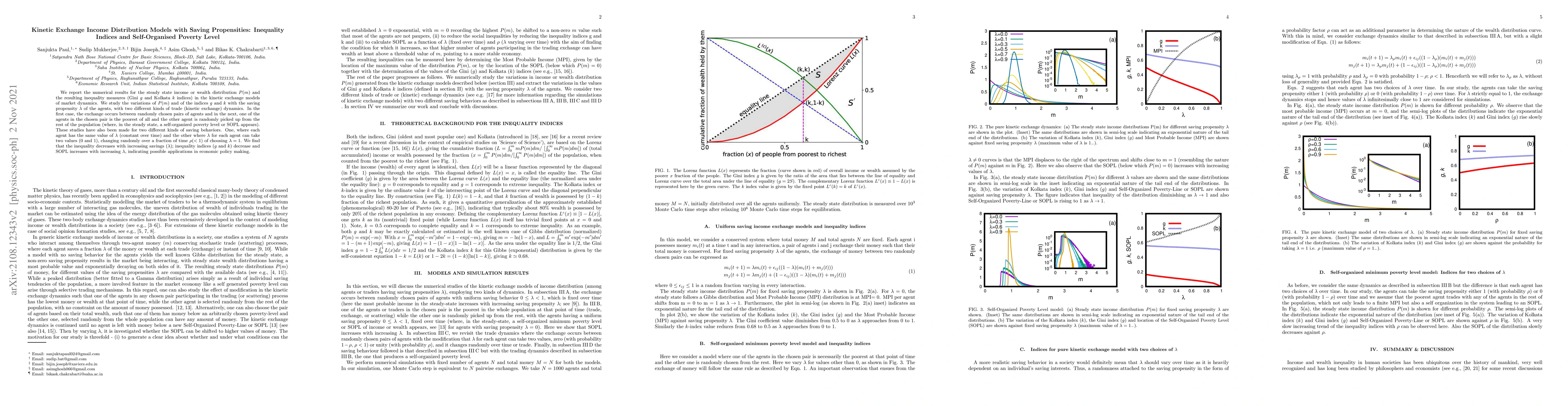

We report the numerical results for the steady state income or wealth distribution $P(m)$ and the resulting inequality measures (Gini $g$ and Kolkata $k$ indices) in the kinetic exchange models of market dynamics. We study the variations of $P(m)$ and of the indices $g$ and $k$ with the saving propensity $\lambda$ of the agents, with two different kinds of trade (kinetic exchange) dynamics. In the first case, the exchange occurs between randomly chosen pairs of agents and in the next, one of the agents in the chosen pair is the poorest of all and the other agent is randomly picked up from the rest of the population (where, in the steady state, a self-organized poverty level or SOPL appears). These studies have also been made for two different kinds of saving behaviors. One, where each agent has the same value of $\lambda$ (constant over time) and the other where $\lambda$ for each agent can take two values (0 and 1), changing randomly over a fraction of time $\rho(<1)$ of choosing $\lambda = 1$. We find that the inequality decreases with increasing savings ($\lambda$); inequality indices ($g$ and $k$) decrease and SOPL increases with increasing $\lambda$, indicating possible applications in economic policy making.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersKinetic Exchange Models of Income and Wealth Distribution: Self Organization and Poverty Level

Bikas K. Chakrabarti, Sanjukta Paul

Kinetic modeling of economic markets with heterogeneous saving propensities

Chuandong Lin, Lijie Cui

| Title | Authors | Year | Actions |

|---|

Comments (0)