Authors

Summary

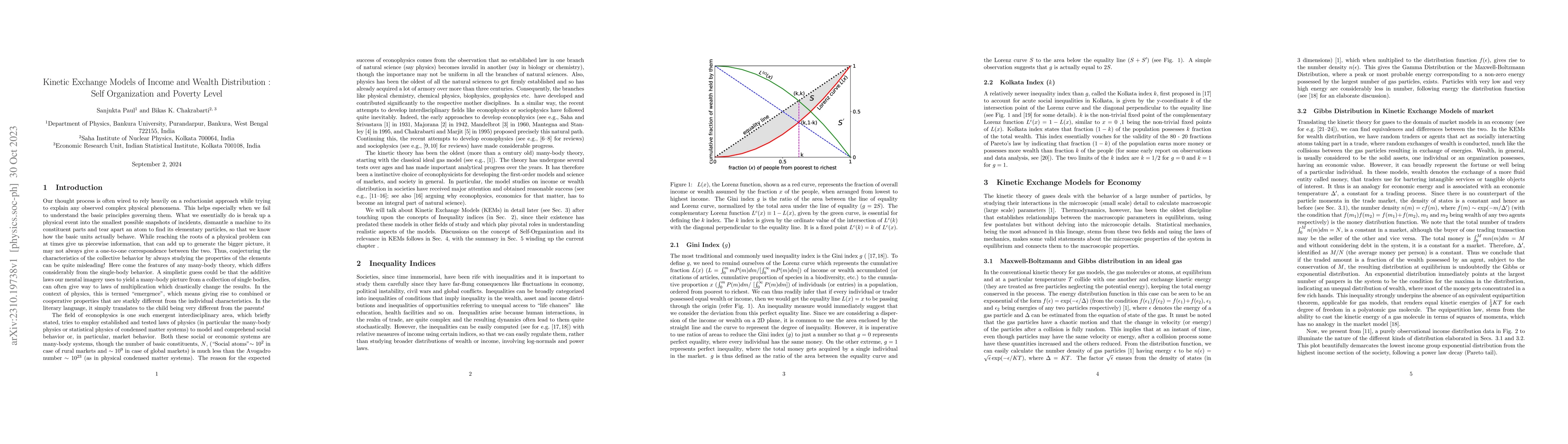

In this invited book chapter, we draw the reader to a brief review of the different Kinetic Exchange Models (KEMs) that have gradually developed for markets and how they can be employed to quantitatively study inequalities (the Gini Index and the Kolkata Index) that pervade real economies. Since a many-body economical market can be studied using tested laws of physics, these models have the freedom to incorporate provisions like inclusion of individual saving behaviors while trading and rendering these saving behaviors to be time-independent and time-dependent respectively. This is to observe when and how the well known exponential distribution for no-saving gives rise to a distribution with a most probable income. A review of the earlier cases along with their implementation with a bias, where the population in the low-income bracket of the society is favored by selecting one of the traders in the trading process to be the poorest of all, follows. The biased selection of agents ultimately giving rise to self-organizing features in the money distribution has also been reviewed in detail, using the behavior of the Self-Organized Poverty Level. In the end, we elucidate the recent endeavors of the KEMs in finding answers to the growing condensation of wealth in the hands of a countable few rich people and providing probable solutions that can curb further expansion of oligarchic societies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersKinetic Exchange Income Distribution Models with Saving Propensities: Inequality Indices and Self-Organised Poverty Level

Sudip Mukherjee, Bikas K. Chakrabarti, Asim Ghosh et al.

No citations found for this paper.

Comments (0)