Summary

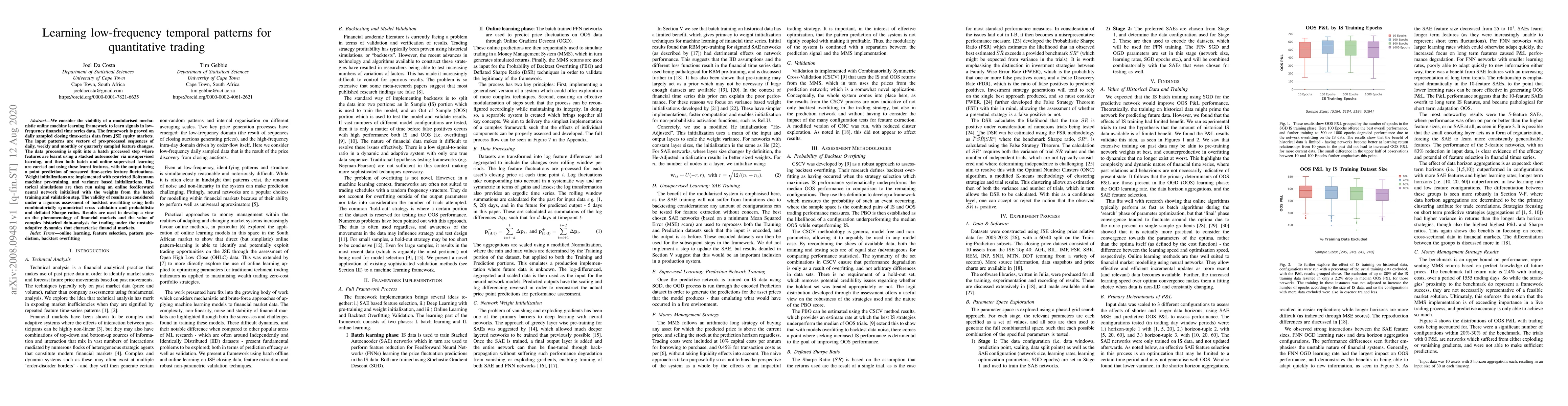

We consider the viability of a modularised mechanistic online machine learning framework to learn signals in low-frequency financial time series data. The framework is proved on daily sampled closing time-series data from JSE equity markets. The input patterns are vectors of pre-processed sequences of daily, weekly and monthly or quarterly sampled feature changes. The data processing is split into a batch processed step where features are learnt using a stacked autoencoder via unsupervised learning, and then both batch and online supervised learning are carried out using these learnt features, with the output being a point prediction of measured time-series feature fluctuations. Weight initializations are implemented with restricted Boltzmann machine pre-training, and variance based initializations. Historical simulations are then run using an online feedforward neural network initialised with the weights from the batch training and validation step. The validity of results are considered under a rigorous assessment of backtest overfitting using both combinatorially symmetrical cross validation and probabilistic and deflated Sharpe ratios. Results are used to develop a view on the phenomenology of financial markets and the value of complex historical data-analysis for trading under the unstable adaptive dynamics that characterise financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Reinforcement Learning for Quantitative Trading

Jiawei Du, Zheng Tao, Zixun Lan et al.

C++ Design Patterns for Low-latency Applications Including High-frequency Trading

Paul Bilokon, Burak Gunduz

| Title | Authors | Year | Actions |

|---|

Comments (0)