Authors

Summary

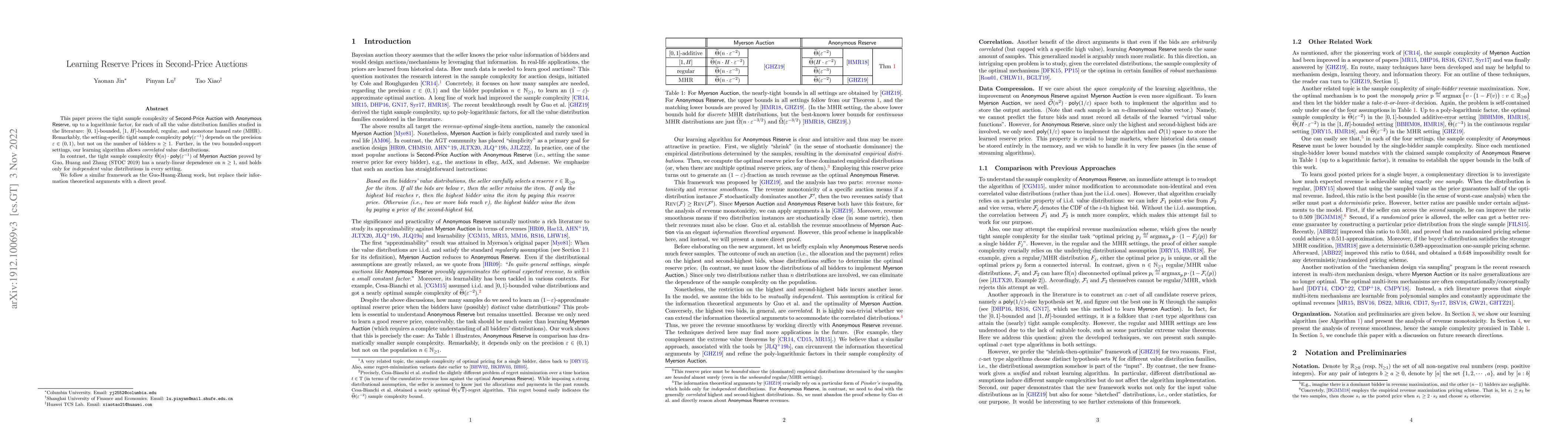

This paper proves the tight sample complexity of {\sf Second-Price Auction with Anonymous Reserve}, up to a logarithmic factor, for each of all the value distribution families studied in the literature: $[0,\, 1]$-bounded, $[1,\, H]$-bounded, regular, and monotone hazard rate (MHR). Remarkably, the setting-specific tight sample complexity $\mathsf{poly}(\varepsilon^{-1})$ depends on the precision $\varepsilon \in (0, 1)$, but not on the number of bidders $n \geq 1$. Further, in the two bounded-support settings, our learning algorithm allows {\em correlated} value distributions. In contrast, the tight sample complexity $\tilde{\Theta}(n) \cdot \mathsf{poly}(\varepsilon^{-1})$ of {\sf Myerson Auction} proved by Guo, Huang and Zhang (STOC~2019) has a nearly-linear dependence on $n \geq 1$, and holds only for {\em independent} value distributions in every setting. We follow a similar framework as the Guo-Huang-Zhang work, but replace their information theoretical arguments with a direct proof.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)