Summary

The SABR model is a cornerstone of interest rate volatility modeling, but its practical application relies heavily on the analytical approximation by Hagan et al., whose accuracy deteriorates for high volatility, long maturities, and out-of-the-money options, admitting arbitrage. While machine learning approaches have been proposed to overcome these limitations, they have often been limited by simplified SABR dynamics or a lack of systematic validation against the full spectrum of market conditions. We develop a novel SABR DNN, a specialized Artificial Deep Neural Network (DNN) architecture that learns the true SABR stochastic dynamics using an unprecedented large training dataset (more than 200 million points) of interest rate Cap/Floor volatility surfaces, including very long maturities (30Y) and extreme strikes consistently with market quotations. Our dataset is obtained via high-precision unbiased Monte Carlo simulation of a special scaled shifted-SABR stochastic dynamics, which allows dimensional reduction without any loss of generality. Our SABR DNN provides arbitrage-free calibration of real market volatility surfaces and Caps/Floors prices for any maturity and strike with negligible computational effort and without retraining across business dates. Our results fully address the gaps in the previous machine learning SABR literature in a systematic and self-consistent way, and can be extended to cover any interest rate European options in different rate tenors and currencies, thus establishing a comprehensive functional SABR framework that can be adopted for daily trading and risk management activities.

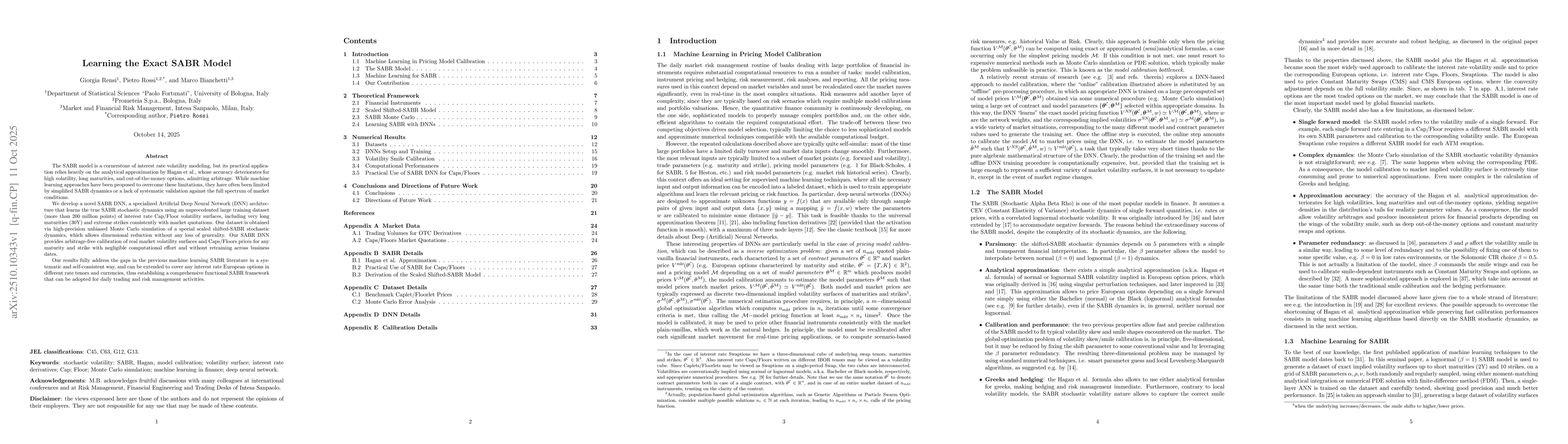

AI Key Findings

Generated Nov 01, 2025

Methodology

The research employs a combination of Monte Carlo simulations and analytical models to evaluate pricing errors in Caplet/Floorlet options under shifted Black models. It analyzes the impact of volatility parameters, correlation, and time-to-maturity on pricing accuracy.

Key Results

- Monte Carlo pricing errors are systematically smaller for out-of-the-money (OTM) short-term options due to low payoff variance.

- Longer maturity options exhibit higher variance, with ITM Floorlets showing lower MC errors due to the rate shift constraint.

- The shifted Black model analysis reveals asymmetric behavior in payoff distributions, affecting variance calculations for Caplets and Floorlets.

Significance

This study provides critical insights into option pricing accuracy under different volatility scenarios, helping financial institutions better manage risk and improve derivative pricing models.

Technical Contribution

The research develops a comprehensive framework for analyzing Caplet/Floorlet pricing errors using both simulation and analytical approaches, with specific focus on shifted Black models.

Novelty

This work introduces an analytical examination of payoff distribution asymmetry in shifted Black models, providing new insights into how volatility parameters affect pricing errors in options.

Limitations

- The analysis is limited to specific volatility parameter ranges and does not account for all market conditions.

- The Monte Carlo simulations require significant computational resources for high-precision results.

Future Work

- Extending the analysis to include stochastic volatility models for more realistic market conditions.

- Investigating the impact of different shift parameters on pricing accuracy across various maturity ranges.

Paper Details

PDF Preview

Similar Papers

Found 5 papersOption pricing under the normal SABR model with Gaussian quadratures

Jaehyuk Choi, Byoung Ki Seo

Comments (0)